By Albert Lau, Financial Services Innovation Principal, Alibaba Cloud

We discussed about the innovation boom in China in our last article, covering mutual insurance product that hit 10 million customers in 10 days, loans with STP approval based on big data and yielding better bad debt rate than the traditional big players, etc.

A less rigorous dissertation of the competitive threat comes in multi-dimensional as follows.

Consider the case of payments. It is estimated that as much as half of global digital commerce volume is already inaccessible to traditional issuers/networks, with that share potentially growing to two-thirds over the next several years. This is because of the alternative payments methods (APMs) build a broader value proposition across the value chain, whereas card issuers had been maintaining their strict focus on the payments event itself. Breaking into these oligopolists' market would probably be unimaginable just 10 years back.

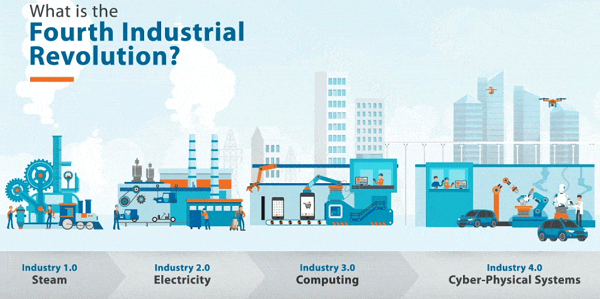

It is beyond the interests of this article to explore what is beyond Fintech 3.0 and Forth Industrial Revolution [1]. One common element is their reference to the technological revolution that would fundamentally alters the way we live, work, and relate to one another.

Source: IEEE

Its definitions would however help the finance institutions examine where they're in their digital transformation journey. The Banker [2] defines Fintech 2.0 as appearing at the start of the 2010s, when banks woke up to the fintech opportunity and started to engage with these companies. Fintech 3.0 refers to a hybrid system that integrates traditional banking with the internet, and banks have become fintech firms themselves, but massive ones. The world's biggest banks, e.g. JPMorgan Chase, Citi, Goldman Sachs, etc have been calling themselves technology companies and have been spending billions on their technology investments. At 2018, JPMorgan Chase had a US$10.8 billion technology budget.

An even more important strategic implication is how fast can this become the norm and catapult the digital economy at large. Let's look into how fast this has happened in China.

All these take only 5 years to where China is today, as described in Part 1 of this article. Once the network effect is in action, there is no return.

Over these few years, banks in China are fortunately not trapped in the boiling frog syndrome, waiting for research and consultancy reports only to be awaken too late in the game. Alibaba Cloud have worked with many banks over the year to assist in their digital transformation experience. We summarize these simplistically into 3 stages to help the readers' learning.

Like most banks, China Guangfa Bank has built its enterprise architecture over the course of technology evolution, with its core banking system, its internet banking application, its mobile banking application, etc. Like most banks, creating a new service at the mobile app requires support from frontend to backend, and requires months for project to get kicked off, tested and deployed.

While this model clearly wouldn't fare well to the business, most banks may be modernizing their microservice architecture and continue to milk their mobile banking application. At best, some may be modernizing their mobile development application framework for refresh the stack for some improvements.

This form of "good-enough" approach is considered risky to the Guangfa CIO. He cited an example with its collateral loan business. Its core system performed wonderfully when it was still handling the offline business. It however broke immediately when connected for the online one. He insisted on a forward looking view in the enterprise architecture planning [4].

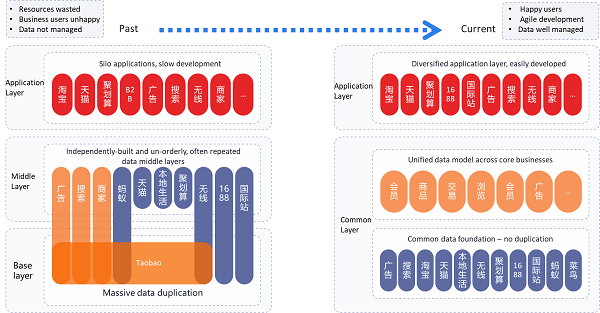

Thus, to address the issues with its 2 poorly-performing mobile app for credit card and mobile banking, it was not only upgrading the mobile application development framework from Alipay called mPaaS [5], it has also chosen to rebuild its integration architecture to follow Alibaba's approach of "Lean application, Big middleware" (厚中台、薄应用). The approach minimizes the common logic like authentication, customer management, etc in the frontend applications, and builds them as common services in the middleware instead. Whilst this approach may not sound revolutionary, its realization in practice at large scale with satisfying customers does set Alibaba apart from the competition.

Alibaba's Data Mid-End: Transformation to Realize "Lean Application, Big Middleware"

Despite the complexity, the apps have been successfully re-launched in around 1 year including the upfront organization changes and training efforts. For example, as of Sep 2018, the credit card application has around 22 million customers, 1.5 million of which are active daily, and 40%+ complete a transaction or more using the app. It features an average load time of just 0.52s. Furthermore, it is verified that it supports a peak load of 45k transactions per second.

So for your case, how do you view the importance of a customer app, as worthy of major transformation effort to get rid of the technology debt and repave a scalable foundation?

With the success of the platform business of the leading Internet companies, such as Alibaba, Facebook, Apple, etc, platform becomes a hot buzzword in the digital transformation discussion.

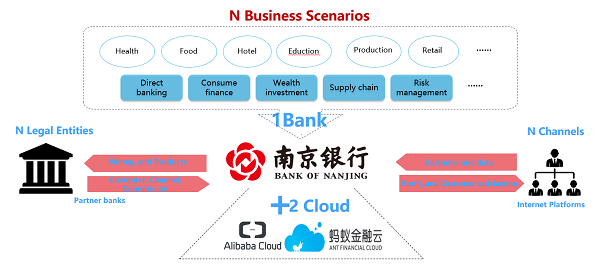

Bank of Nanjing has vividly expressed the benefits of such a platform – the bank's retail finance gathered a revenue of around 10 billion in the last 10 years, whereas its online platform business gathers a revenue of 15 billion in just 1 year [6]. This also objectively exemplifies the opportunity cost of being missed out in the China digital business.

Along with the business growth, the bank experienced a transaction volume of 20k daily to 200k, supporting organizations from a few dozens to a few hundreds, etc. This is a happy problem however that not many small and medium banks could tackle. Bank of Nanjing, thus, further expanded its platform to an open platform to its partner banks to jointly develop their digital businesses.

This "Xin-Cloud" (鑫云+)represents an innovative collaboration model built with Bank of Nanjing itself, based on Alibaba Cloud and Ant Financial Cloud, serving numerous (N) business scenarios, through N channels and N partner banks. This platform allow different collaboration approaches, such as business re-direction, capability sharing, joint product innovation, etc, depending upon the partner banks' own strategic intents and capabilities.

Despite the apparent complexity, Bank of Nanjing has token only 4 months to complete this project based on Alibaba Cloud's middleware solutions such as Alibaba Cloud's EDAS [7], and DevOps solutions. The platform doesn't offer better scalability as one would naturally expect, but also a much lower customer maintenance cost at one tenths whilst accelerating the time-to-market ten times.

Whilst this may sound too good to be true for those who choose to be doubtful, this represents a blue ocean to those who choose to focus on realizing the digital business potentials through addressing key priorities systematically.

We do understand we have significantly abstracted the banks' transformation journey. This is only because we trust most readers are experienced technology veterans who know the problems better than the digital vision. It is the digital vision that is critical to serve as the north star to guide and organize a bank's priorities and efforts.

We would not expect all markets to experience this form of explosive growth at China, where the participants would ruffle and shuffle to make the magic happen within a short duration of 5 years.

However, if we believe that there are time for us to juggle our digital plans year after year, to defer the crucial foundational capability projects to make way for the regulatory ones and to fit into the business budget, we would only be dismissed reluctantly.

Albert works with global and regional financial institutions on their digital transformation and IT strategies. He has hands-on experience with enterprises who still struggle with their legacies, as well as those who are at their advance transformation stages and looking for disruptive proposals. Albert can be reached at linkedin.com/in/laualbert.

Deploying Node.js App in Visual Studio and Deploying on Simple Application Server

2,593 posts | 792 followers

FollowAlibaba Clouder - April 17, 2020

Alibaba Clouder - February 4, 2019

Alibaba Clouder - October 14, 2020

Alibaba Clouder - March 8, 2019

Alibaba Clouder - June 24, 2020

Iain Ferguson - December 17, 2021

2,593 posts | 792 followers

Follow CEN

CEN

A global network for rapidly building a distributed business system and hybrid cloud to help users create a network with enterprise level-scalability and the communication capabilities of a cloud network

Learn More CDN(Alibaba Cloud CDN)

CDN(Alibaba Cloud CDN)

A scalable and high-performance content delivery service for accelerated distribution of content to users across the globe

Learn More WAF(Web Application Firewall)

WAF(Web Application Firewall)

A cloud firewall service utilizing big data capabilities to protect against web-based attacks

Learn MoreMore Posts by Alibaba Clouder