By Albert Lau, Financial Services Innovation Principal, Alibaba Cloud

Whether you have traveled to and lived in China or not, you probably would have heard of stories about how Chinese citizens live their lives on their smartphones. It is no exaggeration that it is a bigger problem that you run out of battery than cash, and thus the pop-ups of all the battery bank services on the street.

None of us would understate the impact of smartphones, although they are only introduced for a little over than 10 years and made popular by Steve Jobs. This only enables the consumption of more digital services at the consumer side though. We may be using 5 apps or 9 apps depending on the consumer research you trust, but this is not linked to the extent and quality of a truly digital lifestyle many of us would like.

Mobile payment provides a second necessary factor for a truly digital lifestyle to flourish. While there are many free internet services, the business world would require a revenue model for more investments to funnel through and grow these digital services. The ability for frictionless payments is essential for the revenue to flow along.

There is naturally the question - which are the world's most digitally advanced countries. In fact, World Economic Forum has commissioned this research called Digital Evolution Index [1], so that we can learn from these economies their innovation recipes. It is noteworthy to note that the world's 3 most significant economies, US, Germany and Japan, are all possibly losing their momentum, and are advised to look to the higher-momentum countries for ideas in getting them back into a zone of greater competitiveness.

The most exciting region in the world, digitally speaking, is Asia, with China and Malaysia as exemplars. China's digital economy is recognized by many as a leading global force, and this article intends to provide a glimpse into the innovation happenings at China, particularly in the financial services sector. While we understand the reader would naturally be curious about the technology innovation enabling these scenes, we would decipher them in the next article along with digital transformation experience of few banking veterans at China to cope with this form of digital sophistication.

Alibaba's four-year-old "Yu'e Bao" fund, a money market fund set up as a repository for leftover cash from online spending has emerged as the world's biggest, with $165.6bn under management. In 2017, this has overtaken JPMorgan's US government money market fund which had $150bn then [2].

There are multitudes of aspects that one would argue if this may be replicated elsewhere around the globe - digital pervasiveness, regulatory permission, public trust, country scale, etc. Regardless, these factors are all marching towards the same direction, at their own pace, globally - towards an open trustable environment along with right level of regulatory oversight per the country maturity.

Last October, Alipay provided this new online "Xianghu Bao" mutual critical illness product that will provide insurance coverage for 100 major illnesses including malignant tumors, with insurance payments to be defrayed by insurees themselves [3]. The product has attracted 3.3 million members in just 3 days, and hit the mark of 10 million at 10 days.

In most countries, this form of hit would be unheard of and unimaginable. However, imagine your country will reach this form of maturity in say 3 years and you have the magic formula to attract this form of craze, what type of technology foundation needs to be in place within your own company? This may be a much stretched goal, but this will certainly be a good strategic discussion with the Board and the CxOs to guide IT strategy and a thought-through change plan to hit the digital vision.

If the above appears to be a glorious result of magical combinations, let's step back and focus on a financial institution's own handling of customers and transactions. Starting from account opening at banks, one may note that the stringent customer due diligence process has turn this experience particularly for start-ups and foreign companies, a nightmare in terms of both the time and efforts required [4]. We have yet mentioned about the average 10% rejection rate. The difficulties in the subsequent process for loans will almost certainly be uneasy, knowing that this is understated.

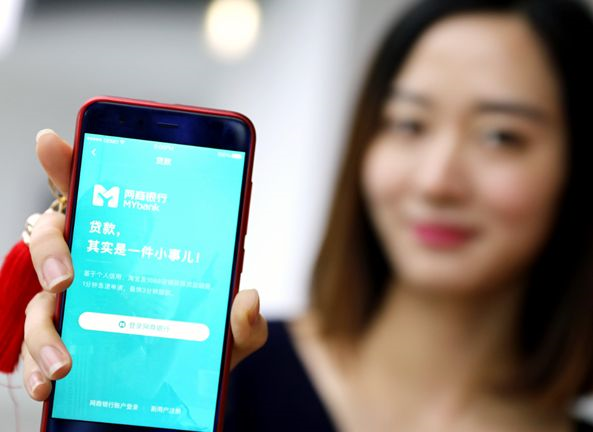

Citing another example from Alibaba again - MYbank. MYbank is a virtual bank which only officially opened at mid 2015 [5]. It has a unique financial inclusion mission to resolve the credits issues encountered by the SMEs and farmers, both of which are unattractive to the traditional established banks. As of mid 2018, MYbank has served over 10 million SMEs amid a much-better-than-average non-performing loan ratio (NPL) at around 1% only.

More interestingly, this is achieved at a backdrop of excellent digital experience based on 3-1-0 model, i.e. 3 minutes for application filling, 1 second to approve and 0 human intervention for this entire process. To date, 95%+ applications are handled fully automatically.

The ability to deliver both customer experience and business performance requires sophisticated risk analytics engine based on both big data and artificial intelligence. In many countries, traditional markers, such as repayment history, are still better predictors of creditworthiness. As such, fintechs in the rest of the world are still wrestling with the ability to combine advanced analytics and distinctive data sources with their existing business fundamentals. The state of digitalization at China has however propelled and matured the risk analytics fintechs [6].

Would 3-1-0 model be a good enough ambition instead to re-chart your digital transformation agenda?

Digital disruption has been termed to explain the dismiss of the previous giants like Nokia, Blockbusters, etc. Yet, the ongoing digital revolution has not just reshaped customer expectation but also redraw and reshaped the industry borders at a pace that we never anticipated.

One obvious evidence is how Ant Financial's Alipay serves as versatile mobile payment platform driving e-commerce transactions and a multitude of online-to-offline services, from ordering takeaway and buying concert tickets to booking flights and hotels. China has long moved from the apps to super apps and expanded online platforms, which support multiple services to offer more convenience to users.

This super app approach is so successful that it is adopted across the global internet industry. For example, Grab is expanding its services to include areas like grocery delivery as part of the firm's goal to build an "everyday app" for consumers, complementing its core strength in transport [7]. The Chinese hotpot chain Hai Di Lao, which has been known for its customer experience [8] and subject of MBA business case studies, has also recently adopted the same approach to elevate its customer experience digitally.

Thus, to the many global financial institutions who are still releasing multiple apps for its customers, say one for mobile banking, one for credit card rewards, one for P2P payment, etc, it is time to look to China for its experience in super apps, understand the peculiar differences with the major mobile development platforms and the additional considerations for them to truly support the demand and experience of the digital ecosystems in action. While API is being celebrated as the fabrics connecting the business organizations, the world should also look at the super apps as the consumer interface that gravitate the users for digital service consumption and further innovation.

Whether you are considering these as inspiring innovations or futuristic craze, it doesn't take away the fact there requires a technology foundation that probably are not yet realized at this scale and sophistication outside China. With this foundation, this enables the digital enterprises to execute their digital business model with engaging customers and energizing their digital lifestyle.

In the next article, we would decipher the technology recipes and the digital transformation experience of some financial institutions for them to compete and thrive in China, one of the world's most digitally advanced countries.

Albert works with global and regional financial institutions on their digital transformation and IT strategies. He has hands-on experience with enterprises who still struggle with their legacies, as well as those who are at their advance transformation stages and looking for disruptive proposals. Albert can be reached at linkedin.com/in/laualbert

Configuring and Mapping Multiple EIPs to ENI Using NAT Gateway

How to Build the Most Effective Backup System - A Conversation with the Expert

2,593 posts | 775 followers

FollowAlibaba Clouder - March 8, 2019

Alibaba Clouder - March 6, 2019

Alibaba Cloud Community - May 16, 2022

Alibaba Cloud Community - January 26, 2025

Alibaba Cloud Serverless - July 9, 2024

Alibaba Cloud Community - May 6, 2022

2,593 posts | 775 followers

Follow CEN

CEN

A global network for rapidly building a distributed business system and hybrid cloud to help users create a network with enterprise level-scalability and the communication capabilities of a cloud network

Learn More WAF(Web Application Firewall)

WAF(Web Application Firewall)

A cloud firewall service utilizing big data capabilities to protect against web-based attacks

Learn More CDN(Alibaba Cloud CDN)

CDN(Alibaba Cloud CDN)

A scalable and high-performance content delivery service for accelerated distribution of content to users across the globe

Learn MoreMore Posts by Alibaba Clouder