In order to win this inevitable battle and fight against COVID-19, we must work together and share our experiences around the world. Join us in the fight against the outbreak through the Global MediXchange for Combating COVID-19 (GMCC) program. Apply now at https://covid-19.alibabacloud.com/

To effectively prevent and control the coronavirus (COVID-19) epidemic, Alibaba Cloud, a member of Shenzhen FinTech Association, has been working to support social distancing as well as highlight enterprises' responsibilities in epidemic prevention and control, guide enterprises to resume production and work in an orderly manner, and improve the efficiency of business communication and coordination. During the epidemic, Alibaba Cloud's new finance team has provided an online business hall solution to Shenzhen FinTech Association members. This solution helps ensure safe and smooth business operations and provides support in the fight against the epidemic.

The sudden outbreak of the COVID-19 epidemic has forced many industries in both China and around the world to cease operations. As the lifeblood of the national economy, the financial industry, which provides financial services to enterprises and individuals, must continue to provide services. But how can financial institutions ensure business continuity in this difficult time? Alibaba Cloud's new finance team quickly launched an online business hall solution to help financial institutions continue to provide online services during the epidemic.

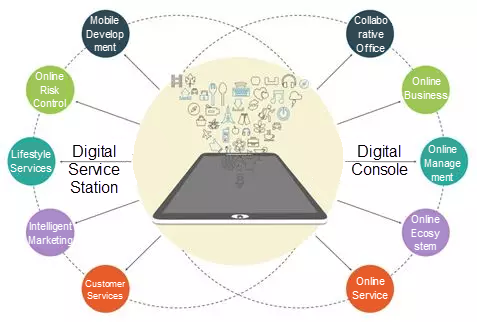

Based on Alibaba Cloud's years of experience in cloud computing, big data, AIoT, audio and video, security, and other fields and Ant Financial's practical experience in online operations and security risk control in large-scale financial scenarios, such as banking, insurance, wealth management, credit, and small and micro loans, Alibaba Cloud's new finance team launched a comprehensive online business hall solution and consulting services for financial institutions. This helps financial institutions provide 24/7 online service without depending on physical outlets. As a result, clients can obtain friendly financial services without leaving their homes.

The digital workspace allows for external scenario-based financial services and internal collaboration to be carried out online. Financial scenarios include remote video-based account opening, remote video-based face-to-face signature, financial risk assessment and financial product purchase, credit card marketing and application, consumer installment loans, financial live broadcasts, 310-type loans for small and micro businesses, investment consultation, and agreement signing. Financial-level biometric verification, intelligent audio and video recording, real-time risk control for global businesses, comprehensive security protection, video surveillance, intelligent quality inspection, and Identity as a Service (IDaaS) ensure service security and compliance. Video clerks, remote explanation, face recognition logon, OCR card identification, intelligent customer service, and intelligent voice capabilities ensure a good customer experience. Tools, such as mobile apps, DingTalk, mini programs, webpages, and mobile webpages, effectively support multi-terminal collaboration. Mobile development platforms, intelligent application building platforms, financial business mid-ends, and financial data mid-ends guarantee rapid business innovation for financial institutions.

During the epidemic, financial institutions still need to continue to provide services. This means they must find ways to guarantee employees' health and securely provide business services. With technical support from Alibaba Cloud's new finance team, DingTalk helps financial institutions beat the epidemic through digitalization.

In October 2019, Alibaba released DingTalk Finance, which redefines financial work in the AI era. DingTalk Finance precisely solves the four major pain points financial customers encounter during work collaboration. The complete collaboration architecture makes communication and collaboration smoother. The hybrid cloud architecture makes data more secure. The comprehensive work platform makes collaboration more efficient. Digital operations ensure precise decision-making and timely responses.

DingTalk Finance features an exclusive design, exclusive security features, and exclusive level of openness. First, the enterprise can configure logos with one click and customize skins and documents to build its dedicated DingTalk. Second, exclusive security features ensure controllable enterprise data security. Enterprise administrators can log on to the DingTalk management console to configure local storage and read data from and write data to files on the DingTalk mobile client. The enterprise data center is equipped with Alibaba Cloud Apsara Stack. Exclusive integration helps each financial institution build a unified portal for online businesses and provide an exclusive work portal to each employee.

DingTalk provides four main benefits: security and efficiency, an excellent experience, a unified portal, and intelligent digital operations. Security and efficiency have always been the key concerns of DingTalk. DingTalk complies with the following security standards: ISO 27001:2013 information security management system standard certification, ISO 27018:2014 public cloud personal identification information (PII) protection and management system, SOC 2 Type 1 service audit reports, and information system level-3 classified protection certification from the Ministry of Public Security. In various application scenarios, DingTalk starts up immediately when a user opens the chat window to integrate communication with business operations.

DingTalk Finance is deeply integrated with the DingTalk cloud videoconferencing system. Using their mobile phones, users can scan a QR code to initiate or join a video conference in 1 minute. The DingTalk unified address book ensures more secure video conferences and easier management. Together, these features provide users with a quality experience.

The unified portal integrates several office scenarios, including human resources, administration, office work, finance, procurement, and business as well as ERP, OA, financial systems, and the app store. Efficient and digital collaboration, transparent online organizations, and online business data allow financial institutions to easily implement intelligent digital operations.

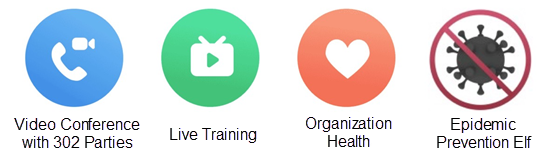

In addition, DingTalk provides multiple features for free, including video conferences with up to 302 parties, live training, organization health, and the Epidemic Prevention Elf provide the employees of financial institutions with an online protective suit and effective and convenient digital office tools.

1. Health Reports:

How can financial institutions guarantee the health and safety of employees while providing customers with basic financial services and continue financial business handling?

Forms can be filled out on DingTalk. Similarly, employees can submit a daily health report and photos of the implementation of safety protection procedures to DingTalk.

2. Intelligent Approval:

How can you ensure the health report and the approval request for going back to work is authentic and valid without having it be signed in person?

DingTalk can help with all of this. You can quickly configure the approval process to return to work through DingTalk, in which the submission and handling of requests and health reports can be completed. Next, DingTalk supports handwriting signatures. The corresponding documented can be exported to a PDF format that cannot be modified but can be conveniently printed and archived.

3. Emergency Notifications:

How can we notify people of emergency information and important policy information in a timely fashion?

DingTalk supports group announcements, as well as the DING notification, which can work as a phone call notification, and an AI-powered chatbot. Through all of these features, DingTalk can helped to get important information to people quickly. DingTalk also shows whether a message is sent and read, so that you can know with confidence that your message was received.

4. Efficient Communication:

How can communication be established in an effectively manner when employees working remotely or located at different locations?

DingTalk can effectively and efficiently connect employees that are working in different locations. DingTalk comes with several features free of charge, including voice- and video-conference capabilities that allow for up to 302 people to join a single sessions. In video conference calls, presenters can easily share screens and share documents.

5. Multi-Role Collaborative Organization:

Financial institutions often have a large number of employees and associated personnel, and their internal structure can be complex and be spread over a large geographical region. With all of this considered, how can financial institutions quickly build an organizational structure that includes regular employees, branches and outsourcing personnel?

DingTalk can be used to quickly and organically build an organizational structure through its platform. First, DingTalk has an organization address book, which supports the quick import and generation of organization structure and department groups in an automatic manner. Supervisors in organization can manage the members of their departments and invite new employees to join the organization. DingTalk also provides a corresponding address book interface to call and synchronize internal system data and set the range to access the address book in batches.

6. Project Task Allocation:

How can we ensure the orderly arrangement and implementation of project tasks?

DingTalk can help with this. For any organization, it is important to clearly define tasks and manage progress. DingTalk project group allows you to do this by communicating safely and creating and assigning work tasks, and tracking the task statuses in a quick and convenient manner.

7. Outsourcing Management:

How can we carry out outsourcing personnel management remotely?

DingTalk allows you to be able to initiate several basic management requirements, such as the scheduling, attendance, daily reports and approval processes. Through this unified systems, such information about outsourced personnel can be easily accessed and reviewed.

8. Job Training:

How can we carry out important strategies, such as going back to work after the epidemic is over, and job training for employees?

The DingTalk platform has several features that can help in this regard. For example, DingTalk's live broadcast function can support millions of people to complete online learning through various training groups and online classrooms to name but two.

Alibaba Cloud provides comprehensive technical support for Teambition, a tool designed to manage tasks and projects. It supports remote work for tens of thousands of Alibaba employees and tens of millions of enterprises, providing in-depth integration of communication with tasks and projects. This tool allows users to easily plan their work, synchronize their progress anytime, and precisely implement tracking. During the epidemic, Teambition is open to the public for free. It has become a new weapon in the remote office arsenal of many financial institutions.

In the face of this unprecedented epidemic, strong technical support is a key variable that determines whether the financial industry can operate normally and provide the financial underpinning needed for the stable operation of the national economy. At this critical moment, Alibaba Cloud's new finance team provided the comprehensive online business hall solution and consulting services for financial institutions. This has become an important technical support for financial institutions as they continue to provide business services.

During the epidemic, Alibaba's DingTalk platform launched a free employee health report service and remote office solution. This safeguards the health of financial institution employees and allows for digital and intelligent remote collaboration.

So, that wraps up the over of the new finance team's online business hall solution. I hope that it will be helpful to other members of the Shenzhen FinTech Association, and I hope that we will defeat this epidemic soon so that we can all return to work safely. The Shenzhen FinTech Association and all its members are taking actions to do our part in the fight against the epidemic.

See the original article in Chinese here.

While continuing to wage war against the worldwide outbreak, Alibaba Cloud will play its part and will do all it can to help others in their battles with the coronavirus. Learn how we can support your business continuity at https://www.alibabacloud.com/campaign/fight-coronavirus-covid-19

How Alibaba Built a Smart Office Ecosystem in the Insurance Industry

How Can Small Businesses Survive the COVID-19? Learn How Innovative Financial Models Can Help

2,599 posts | 764 followers

FollowAlibaba Clouder - April 16, 2020

Alibaba Clouder - April 29, 2020

Alibaba Clouder - April 17, 2020

Alipay Technology - May 14, 2020

Iain Ferguson - April 18, 2022

Alibaba Clouder - March 23, 2020

2,599 posts | 764 followers

Follow Security Center

Security Center

A unified security management system that identifies, analyzes, and notifies you of security threats in real time

Learn More WAF(Web Application Firewall)

WAF(Web Application Firewall)

A cloud firewall service utilizing big data capabilities to protect against web-based attacks

Learn MoreLearn More

More Posts by Alibaba Clouder