In order to win this inevitable battle and fight against COVID-19, we must work together and share our experiences around the world. Join us in the fight against the outbreak through the Global MediXchange for Combating COVID-19 (GMCC) program. Apply now at https://covid-19.alibabacloud.com/

By Miao Xiali from Zhou Dao.

"How can my business survive the COVID-19 epidemic?" This is a big question that many small business owners are asking themselves all around the world, from China to the US and from Italy to Brazil.

"The fact is many enterprises lack funds to survive at critical times or when a major disaster occurs. However, if they have some breathing room, they may also have many opportunities for further growth and development," said Yang Chen, deputy general manager of DAQ Soft.

DAQ Soft has been engaged in the smart tourism industry for over a decade in China. Yang Chen expected business transactions to increase dramatically on the night of New Year's Eve. However, as tourist attractions closed one after another, his business turnover was almost completely flat, being close to zero.

The sad reality is that before this epidemic is over, several companies may go bankrupt. Understanding the great gravity of this situation, the Alibaba Cloud's new finance team is providing blockchain finance and supply chain finance solutions to the companies that need it the most.

An company that tried to stay afloat all alone will not last long, especially now. But if companies from all over the industry team up, companies are much less likely to fail and the whole of the industry should come out even better than before.

"In the modern economy, the enterprises in an industry are linked in an industry chain," said the Ant Double Chain product manager at Ant Financial. An enterprise that goes at it alone will not last long. Only when all the enterprises in the industry chain team up can the industry survive and even become better.

In the automobile industry, a car consists of tens of thousands of or even hundreds of thousands of parts from hundreds of suppliers.

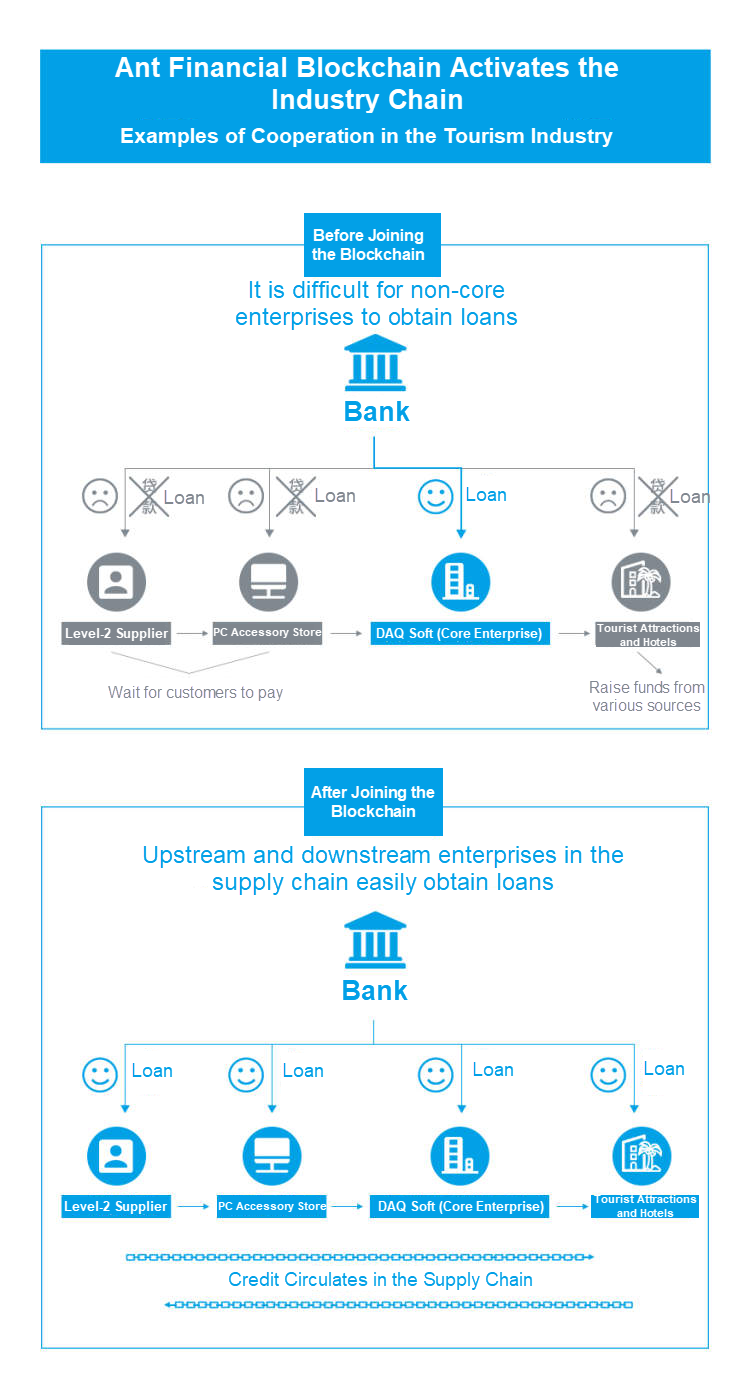

These suppliers supply goods to a core enterprise, and the core enterprise pays these suppliers. If the core enterprise receives funding support from financial institutions during the epidemic, the supply chain of the core enterprise will be nourished and can restart work simultaneously. This ensures businesses can continue operating and maintain their employees.

This is the concept of supply chain finance. Supply chain finance products can quickly solve the urgent needs of small and micro businesses.

In addition to supply chain finance, blockchain technology is also required. The tamper-proof blockchain can help financial institutions intuitively understand the real status of core enterprises and suppliers in the supply chain.

This way, they do not need to perform offline investigations of enterprises. Enterprise information is uploaded to the blockchain after being confirmed. Information on the blockchain is tamper-proof and irrevocable, allowing banks to directly consult the information on the blockchain.

On the chain, the core enterprise issues a payment credential for accounts payable (AP). With the payment credential, small and micro businesses in the industry chain can apply for a loan online from banks that cooperate with Ant Financial. They do not need to go through complicated procedures as before. In other words, a loan can be made in seconds.

If upstream tourist attractions cannot resume operations, many downstream suppliers will go broke. Even though DAQ Soft obtained a loan to survive the epidemic, this alone is not enough because enterprises in the industry chain coexist," said Yang Chen of DAQ Soft.

For example, a digital tourist attraction requires VR devices, turnstiles, CCTV, sensors, detectors, and surveying equipment from hundreds of suppliers in different industries. By integrating hardware and software, DAQ Soft provides digital tourism solutions that allow tourist attractions to receive hundreds of millions of tourists.

Tourist attractions would receive ticket revenue when they start to operate again, so many banks are willing to provide loans to them. However, their credit limits will be lowered in the event of a serious epidemic, like COVID-19. To ensure sustainable development, enterprises require liquidity and a large amount of funds for informatization and reconstruction as well as promotion and marketing.

"If an enterprise has previously made transactions on Ant Double Chain products (supply chain + blockchain), I can obviously see that the enterprise's daily cash flow can reach 200,000 or 300,000 yuan after the epidemic is over. Therefore, extending them a credit line of, for example, 1 million yuan, I will not be taking on too much risk," said Yang Chen, the deputy general manager of DAQ Soft. Due to the tamper-proof nature of Ant Double Chain products, I can ensure that a certain amount of funds will be returned to my capital pool from each ticket sold at all tourist attractions to repay the principal and interest of the loan after the epidemic is over.

This will ensure tourist attractions to have the funds necessary to promote development and attract more tourists. "By allowing companies to borrow against future funds to cope with unexpected risks, Ant Double Chain actually opens a new channel, a window, which we call the securitization of tourist attraction assets," said Yang Chen.

In August 2019, Bank of Chengdu and Ant Financial tried to use financial technology (fintech) to solve certain problems. They used blockchain to reconstruct traditional supply chain finance and created the Ant Double Chain model. DAQ Soft also joined the blockchain.

Zheng Hao, Ant Double Chain product manager at Ant Financial, said "DAQ Soft is a core enterprise in the industry chain. An IOU from DAQ Soft can help small enterprises obtain loans, and DAQ Soft can activate capital requirements, financing requirements, and credit assets throughout the industry chain. It is an important node in the blockchain and a mainstay in the supply chain."

It was reported that Fan Lei, the financial controller of DAQ Soft, was busy with the office move and had no time to review financial affairs after the resumption of work on February 17. Although the procurement department phone was constantly ringing with calls from debt collectors, she did not want to worry her partners. If DAQ Soft could not make payments on time, her partners can use the IOU issued by DAQ Soft to apply for loans from the Bank of Chengdu.

"After the New Year holiday, we faced a large number of capital requirements from small and micro businesses. We provided about 100 million yuan (14 million dollars) for upstream small and micro businesses after the New Year holiday," said Jin Qinghai, vice president and board secretary of 1919.

1919 is the largest alcohol e-commerce platform in China. In 2018, 1919 obtained an 2 billion yuan strategic investment from Alibaba and became the world's largest unicorn in the alcohol new retail field.

1919 has a business model with deeply integrated online and offline businesses. The 1919 Food & Drink app is the core of the company's online business, and 1919 has more than 1,900 offline stores in over 500 cities in China. It has more than 12 million registered members and can provide free alcohol purchase service to store-based users in 19 minutes.

"In this model, we need a strong supply chain to support development. To solve differentiation and pricing problems, the whole industry chain must provide good service benefits and performance," said Jin Qinghai.

Due to the epidemic, a third of the 1,900 stores could not be opened. In areas with serious outbreaks and stricter control requirements, stores were required to shut down. Some residential communities even restricted the flow of residents. This had a significant impact on consumption. "Currently, 1919 orders are mainly placed online. Even though half of the company's business came from online channels before, the overall online sales volume was lower than expected."

Having developed from a single shop to the unicorn of the alcohol new retail field, 1919 knows that it is difficult and expensive for small and micro enterprises in the industry chain to raise funds.

In 2013 and 2014, 1919 had completed the informatization and digitalization of its businesses and moved all business processes online. This provided strong support to Ant Double Chain products.

"Looking at the whole chain, upstream enterprises may be frontline producers, such as Maotai, Wuliangye, Yanghe, and Guojiao in China and Diageo, Budweiser, Pernod Ricard, and Penfolds outside China. They have a large amount of funds and want to participate in the supply chain financing, giving funds to suppliers to ensure their supply chains remain intact. Some banks can also provide financial services to SMEs based on the data of core enterprises."

Double Chain has provided a risk control model and performance system that can empower entire industries through core enterprises.

"Since February, many small and micro businesses in new retail and other fields have submitted their financing requirements through our platform," said Liang Rong, a blockchain product expert at Ant Financial. As long as core enterprises can obtain credit from banks or through financial guarantees, Ant Financial can provide financial services to core enterprises and the suppliers in their supply chains.

Currently, over 30,000 enterprises use the Double Chain service on the Ant Financial blockchain platform and are in contact with mainstream banks.

Ant Double Chain has activated supply chain financing, significantly expanding credit availability and financing coverage. There are 275 registered financing guarantee institutions in China, which can cover over 10 million small and micro businesses.

According to market research, the size of the supply chain financing market was about 87 trillion yuan (12 trillion dollars) in 2018. Ant Double Chain's accounts receivable market accounted for 20 trillion yuan (2 trillion dollars) of the total market.

Only by working together to overcome our current difficulties can we reap the rewards when the epidemic ends. The new financial technologies and models can help enterprises survive this epidemic.

Check out the original article in Chinese.

While continuing to wage war against the worldwide outbreak, Alibaba Cloud will play its part and will do all it can to help others in their battles with the coronavirus. Learn how we can support your business continuity at https://www.alibabacloud.com/campaign/fight-coronavirus-covid-19

How Is Alibaba Cloud Helping Financial Institutions during the Epidemic

Developing an Infrared Thermometer with an App Based on the WiFi Module of AliOS

2,599 posts | 764 followers

FollowAlibaba Clouder - April 13, 2020

Alibaba Clouder - April 17, 2020

Alibaba Clouder - August 14, 2020

Alibaba Clouder - March 24, 2021

Alibaba Clouder - March 23, 2020

Alibaba Clouder - April 23, 2020

2,599 posts | 764 followers

Follow ApsaraDB for OceanBase

ApsaraDB for OceanBase

A financial-grade distributed relational database that features high stability, high scalability, and high performance.

Learn More Security Center

Security Center

A unified security management system that identifies, analyzes, and notifies you of security threats in real time

Learn MoreLearn More

More Posts by Alibaba Clouder