By Alibaba Cloud Data Middle Office

Current data shows that China's dairy industry has entered a stage of large scale and stagnant growth. This is a sign of a mature market and the first pain point facing the dairy industry: The whole industry is confronting a middle-aged bottleneck.

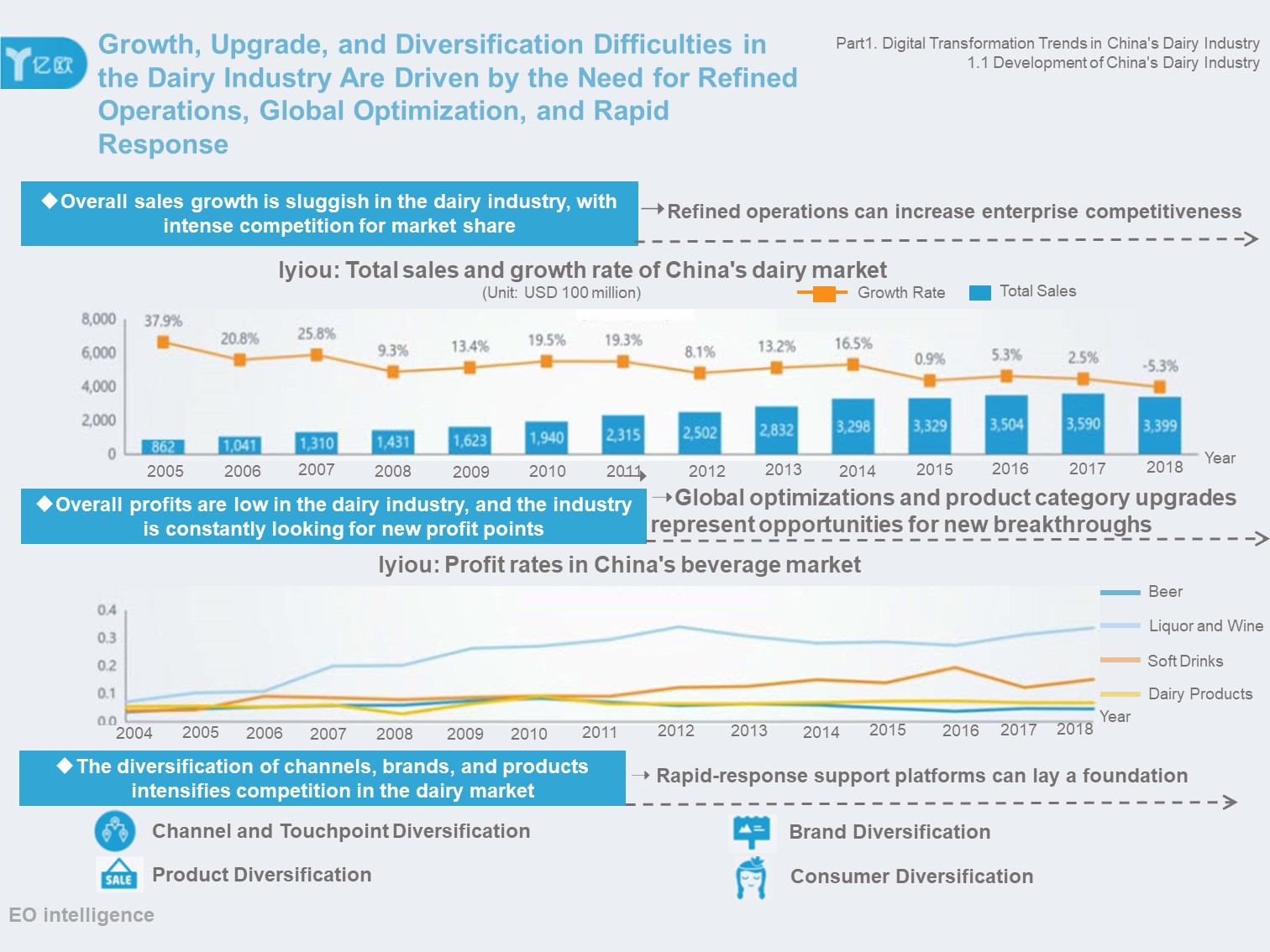

China's dairy market is a mature market of over RMB 100 billion. According to the China Dairy Yearbook data, the size of China's dairy market reached RMB 359.041 billion in 2018, down -5.3% year-on-year, while the total sales volume was 30.99 million tons, up 1.0% year-on-year.

This data clearly shows the current situation in China's dairy industry. It clearly features a large scale but stagnant growth. The Data Mid-End Solutions Report for the China Dairy Industry 2020 published by the Iyiou think tank also reveals the dairy industry's current development problems: growth, upgrade, and diversification.

In 2019, Chinese dairy enterprises did everything they could. Mengniu Dairy continued to exert the power of its global business layout, New Hope Dairy found a path to success in the cold product market, Sanyuan combined meat, vegetables, and milk products to create meal packages, and Beingmate took to social networks for community marketing. In the fierce market competition, all the players are fighting to protect or expand their slice of the pie.

However, the Data Mid-End Solutions Report for the China Dairy Industry 2020 firmly believes that the digitization of individual processes in Chinese dairy enterprises is insufficient for supporting their current development. Therefore, end-to-end and rapid-response digitization solutions will become the new orientation of China's dairy product brands.

But who will drive the advance along this path?

In 2019, well-known Chinese dairy brands such as Feihe and Yashili embraced data mid-ends in quick succession, gradually setting the dairy industry on a path toward digital intelligence.

This article will explore the practical effects of data mid-ends on the Chinese dairy industry by posing three questions.

Before answering this question, we must first analyze the pain points of China's dairy industry.

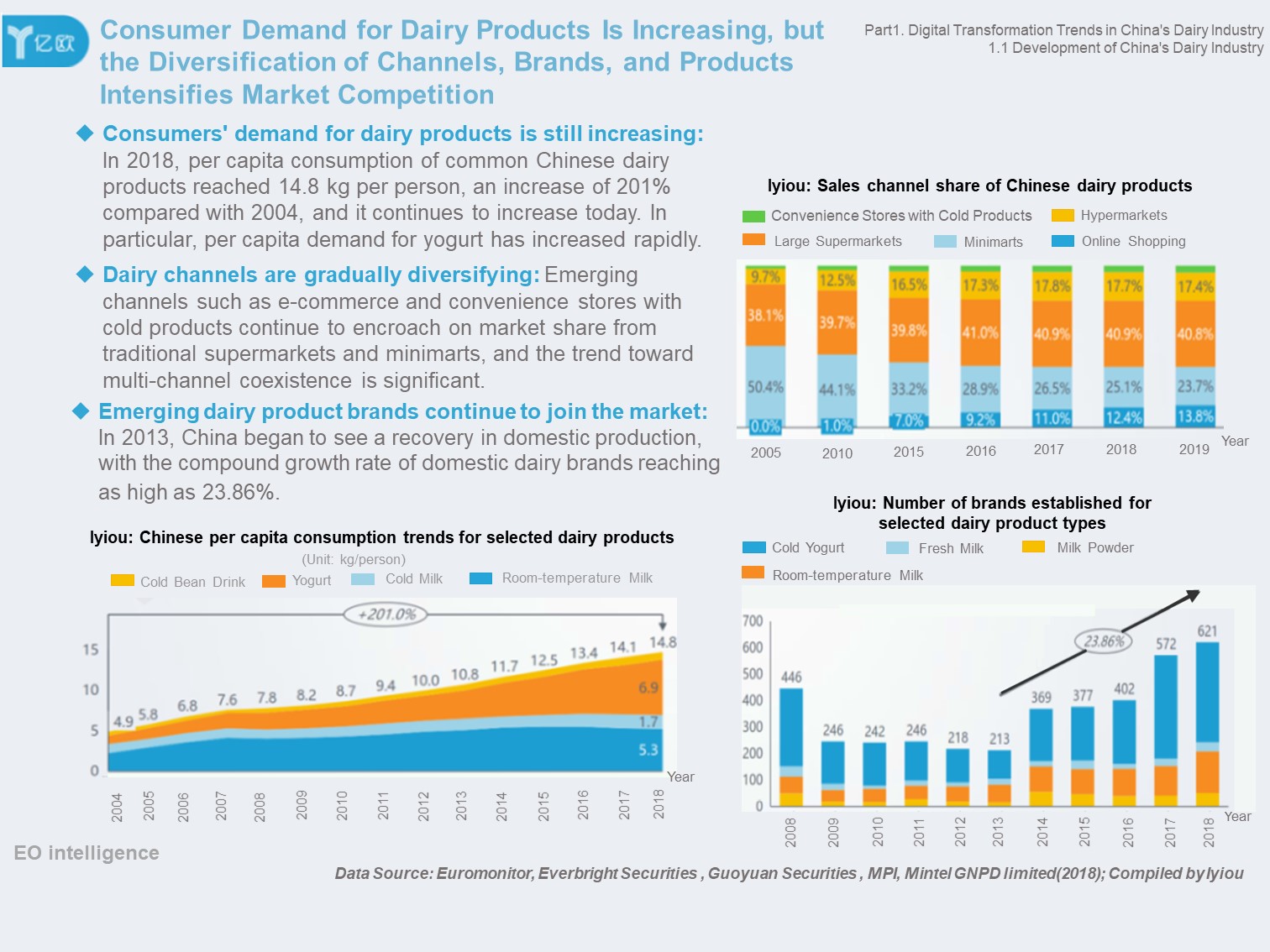

At present, liquid milk accounts for more than 95% of China's dairy market. Liquid milk products are subdivided into many categories, including room-temperature milk, room-temperature yogurt, cold yogurt, fresh milk, and milk-containing beverages. New companies are constantly entering every sector of the downstream finished milk product market. According to Mintel GNPD's data from 2018, between 2013 and 2018, the growth rate of new brands entering the cold yogurt, fresh milk, room-temperature milk, and milk powder segments was as high as 23.86%. This fierce competition led to low profits in the dairy industry, as its overall net profit remained below 7%.

Source: Data Mid-End Solutions Report for the China Dairy Industry 2020

Although the competition in different market segments is fierce, the majority of the market share is still concentrated.

In 2018, the total revenue of Yili, Mengniu, Guangming, and Feihe exceeded RMB 180 billion, accounting for half of the entire dairy industry. Therefore, for group companies, the main difficulty is how to manage their many subsidiary brands and implement comprehensive management across production, supply chains, and marketing for the products of different brands. The main difficulty for smaller companies is optimizing the enterprise's operational efficiency and creating profits from agile and efficient process control.

Due to the popularity of e-commerce and new retail, great changes have taken place in the sales channels of the dairy industry. In 2005, minimarts accounted for 50% of China's dairy sales channels, which now drops to 25% and continues to fall. Online shopping and convenience stores selling cold products are biting into the market share of these channels, while hypermarkets and supermarkets continue to seize the other half of sales channels.

Retail channels have gradually evolved in the direction of standardization, centralization, and greater control. Therefore, dairy companies are trying to control their sales channels better and bring themselves closer to consumers in the distribution and sales processes. This exposes another major pain point: How can companies better manage their channels and better connect to consumers?

While dairy enterprises still lack a good understanding of consumers, consumer preferences are rapidly changing. As a result, companies must update their brands and products more quickly and better understand the needs of consumers.

In the Data Mid-End Solutions Report for the China Dairy Industry 2020, Iyiou summed up the three major pain points facing the dairy industry: growth, upgrade, and diversification.

Here, growth points to the lack of overall sales growth and the competition for existing market share. The dairy industry needs to find a way to achieve another wave of growth.

Upgrade points to the low overall profits in the dairy industry. The industry needs to constantly search for new ways to increase profits.

Diversification points to the diversification of channels, brands, and products, which has intensified competition in the dairy products market. The industry must achieve rapid iteration for products and rapid response for services.

Source: Data Mid-End Solutions Report for the China Dairy Industry 2020

In fact, while digitization can provide new solutions and paths to explore, it cannot completely solve any of these problems alone. For example, to address the problem of growth, refined operations give a possible breakout point, and a sufficient level of digitization is required to provide the foundation of refined operations. To address the upgrade related problems, global optimizations and product category upgrades are likely areas where new breakthroughs can be made, and global optimization is a practice that requires digitization. To address the problem of diversification, it is necessary to strengthen consumer-facing digital construction.

According to the Data Mid-End Solutions Report for the China Dairy Industry 2020, China's dairy industry has basically completed the informatization of important processes (such as quality and safety assurance and supply chain management), but each system has a different level of digitization. In addition, data assets remain isolated, and the connection with consumers is weak. At the same time, Chinese dairy product companies must look for new growth areas, await upgrades, and adapt to the diversification of the industry.

However, in the face of the problems of growth, upgrade, and diversification, the digitization of individual processes can no longer meet the needs of the industry. This is because behind these pain points lies the need for refined operations, global optimization, and rapid response. Therefore, end-to-end and rapid-response digitization solutions will become the new direction of China's dairy product industry.

The report contends that mid-ends can effectively boost the global and agile digitization of the dairy industry. When we discuss the concept of data mid-ends, Alibaba Cloud's perspective cannot be ignored. As the pioneer and practitioner of this concept, Alibaba Cloud defines data mid-ends as intelligent big data systems that integrate methodologies, organizations, and tools in a fast, precise, comprehensive, centralized, and accessible system. This further supports the conclusions of the Iyiou think tank. Iyiou holds that the construction of data mid-ends relies on new technologies, concepts, and methodologies, which solve the problems of traditional data warehouse system construction and effectively adapt to new changes. Accordingly, this will require the digital systems of enterprises to evolve toward data intelligence.

Returning to the original question, we can say that data mid-ends are indeed indispensable if the dairy industry hopes to solve its pain points in the process of digitization.

Enterprises in the dairy industry have already gone through the process of internal informatization. In this process, they were able to improve their storage, management, and use of data. We call this process of digital transformation.

Digitization has two important components: technology and methodology. Technology refers to the technical solutions that databases and data warehouses depend on, while methodology is how dairy enterprises manage data, extract the value of data, and use data to empower their development. This demands a combination of factors, such as the enterprise management philosophy, industry know-how, organizational structure, and employee participation.

Previously, enterprises had less digital information. With a database and a small number of developers, they could obtain the simple business support and analysis capabilities they required. However, as data volumes increased, departments at various levels had to access multiple types of data and multiple databases for daily operations and analysis. This made data extraction and access complicated and led to many problems. For example, data analysis results lacked reliability and the data processing efficiency was low. Meanwhile, it was difficult to convert data into information and other usable assets.

As digitization progresses, enterprises must deal with more data and more operation and analysis objects, which results in a tangled web of connections when using traditional database systems. As a result, data warehouse and online analytical processing (OLAP) technologies have become the most popular solutions.

However, current decision support systems are independent, fixed, and limited. This means they cannot meet the needs of rapid business development.

First, the extract, transform, load (ETL) processes of traditional data warehouses rely heavily on manual operations. Once development is completed, it takes a long time to improve their data carrying and storage capabilities, and costs are high.

Second, the users of traditional decision support systems are high-level administrators. There are no channels that allow business operations staff to use these systems, so they have a hard time adapting to the needs of refined operations.

Third, the increase in touchpoints and business flexibility requires greater elasticity of data capabilities, while data decision-making systems need to adapt to agile business models.

Lastly, traditional decision-making support systems are independent of each other. For example, there are different support systems based on artificial intelligence (AI), data warehouses, and other components. As business complexity increases, the current architectures cannot provide the cross-system decision support capabilities that will be required in the future.

Therefore, it is necessary to construct a new type of data intelligence management system based on new technologies, concepts, and methodologies in order to better meet the current development needs of dairy enterprises.

According to the Data Mid-End Solutions Report for the China Dairy Industry 2020, Iyiou believes that the data mid-end is a new type of data intelligence system that can help enterprises efficiently construct global data assets, agilely empower a variety of businesses, and intelligently serve the staff engaged in each business process. Such a system would be able to meet the current needs of global and agile digitization.

In the report, Iyiou also specifically quoted the data mid-ends definition given by Alibaba Cloud experts: "the data mid-end is an intelligent big data system that differs from traditional data warehouses. It helps enterprises improve data resources, link businesses, and connect organizations."

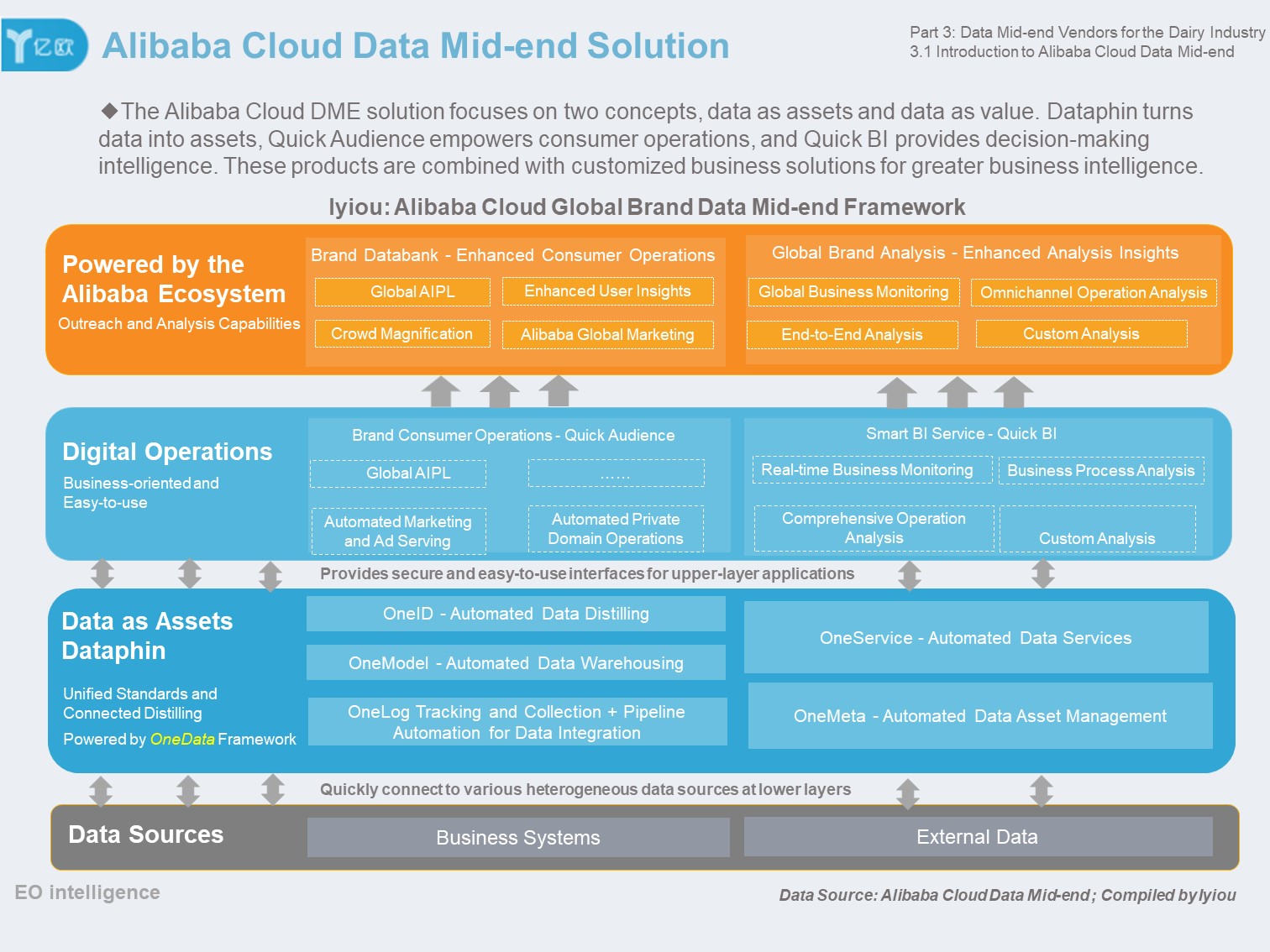

As a leading practitioner in the field, Alibaba Cloud implements data mid-ends in the form of standardized products and solutions, empowering enterprises through Alibaba Cloud Data Mid-End (DME). DME focuses on two concepts: data as assets and data as a value. It advances these concepts through interlocking products. Alibaba Cloud's DME product matrix features three components:

These data construction and management projects strive to use data to create more value.

Alibaba Cloud built up these products and technologies based on its vst experience in the big data industry. Therefore, these products are industry leaders in terms of concept and capabilities. For example, Quick BI provides intelligent BI services for cloud users. In the latest annual Magic Quadrant released by Gartner, world-renowned research and advisory firm, Quick BI became the first and only Chinese BI product to be included in the Magic Quadrant for the BI field. This proves the industry-leading position of the product.

DME leverages a product matrix and business solutions tailored to the industry to drive the digital transformation of dairy enterprises and help them increase their business intelligence capabilities.

Source: Data Mid-End Solutions Report for the China Dairy Industry 2020

According to the Data Mid-End Solutions Report for the China Dairy Industry 2020, data mid-ends in the dairy industry mainly focus on consumer connection processes and are gradually moving up the industry chain to upstream processes. The data mid-end integrates sales and marketing data in consumer connections. The data from all consumer touchpoints and processes is converted into data assets through automatic ETL processes on the mid-end and then stored in the enterprise's internal database. The data assets are managed centrally, and data is integrated and fed back into business systems, supporting precision operations by staff at all levels.

According to Iyiou's research, Alibaba Cloud DME has already shown its value in customer acquisition, conversion, and retention. In the future, it will provide same-source, agile, predictable, backward pass, and bidirectional data capabilities that will be deeply integrated into the production and supply chains. This will lay a comprehensive and improved foundation on which enterprises can increase income and reduce expenses.

As mentioned previously, Feihe Group, one of the four major enterprises in the dairy products industry, is using DME for step-by-step progress in this area. Through investigation, site visits, and in-depth interviews, we found that Feihe's data mid-end is to be implemented in three stages.

The first stage has already been completed. The core of the first phase is consumer services and retail store sales. To complete this phase, the company has planned nine business scenarios: marketing, transactions, public services, products, members, channels, finance, logs, and logistics.

The main goal is to effectively retain customers, deepen operations for existing users, fully empower offline businesses, and assist in shopping guidance. Through these efforts, the company will be able to achieve cross-business customer acquisition, conversion, and retention.

Feihe has achieved the same-source, agile, predictable, backward pass, and bidirectional data capabilities by building a data mid-end. This allows the company to refine its business operations and input relevant data into business processes.

In addition, according to the article, "Yashili: Rushing Forward Like a Rocket, the Data Mid-end Has Touched Off an Organizational Revolution" published by Iyiou, Yashili is using the global brand data mid-end solution provided by Alibaba Cloud DME to explore five business scenarios: shopping guidance, stores, bonus points, marketing activities, and membership.

During the 2019 Double 11 Shopping Festival, Yashili achieved a 92% increase in sales over the same period in the previous year by virtue of the improved marketing efficiency provided by its data mid-end. In addition, the company's new powdered goat milk brand, Doraler, broke into the market. During the 2019 Double 11 Shopping Festival, the brand's total consumers increased 74 times over, as it achieved 118% of its target gross merchandise value (GMV). The sales of its main products also increased by over 1000%.

As with all information system solutions, the final result achieved by an enterprise is highly dependent on the awareness, attention, and recognition with which its employees view the data mid-end solution. Nevertheless, data mid-ends provide dairy product companies with a new development path in the highly competitive consumer goods and food and beverage industries.

The Alibaba Cloud data mid-end team is committed to providing the best practices of Alibaba Cloud's data intelligence to help other enterprises build their own data mid-ends and implement intelligent commerce in the new era!

Solutions and core products of Alibaba Cloud DME include:

We hope to grow together with like-minded customers and users. For more information, visit the official data mid-end website.

The views expressed herein are for reference only and don't necessarily represent the official views of Alibaba Cloud.

The Iyiou Think Tank Report: Alibaba Cloud's DME Is the Preferred Solution in Chinese Dairy Industry

2,599 posts | 764 followers

FollowAlibaba Clouder - November 10, 2020

Alibaba Clouder - April 13, 2020

Alibaba Clouder - October 18, 2019

Alibaba Clouder - March 6, 2017

Nick Patrocky - March 8, 2024

Alibaba Developer - June 15, 2020

2,599 posts | 764 followers

Follow Big Data Consulting Services for Retail Solution

Big Data Consulting Services for Retail Solution

Alibaba Cloud experts provide retailers with a lightweight and customized big data consulting service to help you assess your big data maturity and plan your big data journey.

Learn More Big Data Consulting for Data Technology Solution

Big Data Consulting for Data Technology Solution

Alibaba Cloud provides big data consulting services to help enterprises leverage advanced data technology.

Learn More Cloud Migration Solution

Cloud Migration Solution

Secure and easy solutions for moving you workloads to the cloud

Learn More Data Security on the Cloud Solution

Data Security on the Cloud Solution

This solution helps you easily build a robust data security framework to safeguard your data assets throughout the data security lifecycle with ensured confidentiality, integrity, and availability of your data.

Learn MoreMore Posts by Alibaba Clouder