On June 25, Ant Financial launched the world's first blockchain-based e-wallet cross-border remittance service in Hong Kong. Users of AlipayHK can send remittances to GCash of the Philippines using the blockchain technology. The first remittance was completed in just three seconds by Grace, a Filipino who has been working in Hong Kong for 22 years. In contrast, remittance using traditional methods could take anywhere from several hours to weeks.

"It's cool!" Grace gasped at the service while video chatting with her family back in the Philippines on the phone. Paul Chan (Hong Kong Financial Secretary), Canning Fok (Co-Managing Director of CK Hutchison Holdings), Jack Ma (Chairman of the Board of Directors of Alibaba Group), and Eric Jing (Executive Chairman & CEO of Ant Financial), were present at the event.

Figure 1: From left to right: Canning Fok, Co-Managing Director of CK Hutchison Holdings; Paul Chan, Hong Kong Financial Secretary; and Jack Ma, Chairman of the Board of Directors of Alibaba Group

Figure 2: Eric Jing, Executive Chairman & CEO of Ant Financial

Powered by blockchain, the Ant Financial cross-border remittance service is as simple as a domestic transfer. It supports real-time transfer, which saves money, simplifies procedures, and ensures security and transparency. This is another innovative attempt of Ant Financial on the use cases of blockchain following charity donation, food traceability, and rental management.

How does Ant Financial make available the world's first blockchain-based cross-border remittance service? What are the technical difficulties behind this? This article will explain the technologies behind the service.

At the press conference, Jack Ma recalled a request from a Filipino that he received many years ago. He said, "When can we use Alipay to remit money back home? Remittances cost so much." He had asked Eric Jing, Executive Chairman & CEO of Ant Financial, the same question for dozens of times in the past year. "Today I am very happy to witness this amazing moment."

Apart from carrying cash at hand, a standard way of cross-border remittance is transfer by bank or remittance company, where a withdrawal code is generated after remittance, and a recipient withdraws cash with the code. It happens in both online and offline payments.

However, traditional cross-border remittance services have limitations. Due to the involvement of more parties and exchange rate issues, the process is complicated and can take several weeks before receipt. Furthermore, traditional remittance services are limited by bank hours, which is complicated when dealing across multiple time zones.

Grace had such experiences. She told reporters that she regularly remitted money to the Philippines but did not feel assured because it took a long time before receiving a receipt message from her family in the Philippines. "If only I could transfer money like my Hong Kong friends." There are nearly 200,000 Filipinos who currently live and work in Hong Kong like Grace.

Image 3: Grace, a Filipino who has been working in Hong Kong for 22 years (on site) completed the first remittance.

To solve these limitations, AlipayHK and GCash (e-wallet of the Philippines) have been looking for solutions until they met the blockchain team of Ant Financial. Ant Financial filed the largest number of blockchain patents in the world in 2017 and has been exploring the boundaries of blockchain applications.

However, there are reports that a bank has offered the cross-border remittance service using internal blockchain, which however does not support cross-institutional transfer. Transfer between users and banks still follows the traditional way. The cryptocurrency-based cross-border remittance service is also available, but it is not possible to put it into mass commercial use as the demand and supply of cryptocurrency, and the currency value may fluctuate wildly in short time.

Now AlipayHK and GCash jointly launched the world's first e-wallet that uses the blockchain for the full link of cross-border remittance. Standard Chartered Bank is responsible for the liquidation of funds and foreign exchange at the end of the day. GCash users can spend money immediately upon receipt. This cross-border remittance service provides real-time round-the-clock transfers (just as domestic transfers do) which save money, simplify procedures, and ensure security and transparency. In this way, cross-border remittance gets redefined.

From Hong Kong to the Philippines, the blockchain-based cross-border remittance service has taken the first step, and in the future, will benefit more countries and regions.

The blockchain is a distributed ledger of data records that is jointly maintained by multiple parties and continuously stored in a blockchain structure. The content and time sequences of these records are protected using cryptography so that any party cannot alter, repudiate, or falsify them.

In this remittance, the distributed ledger technology of blockchain gets used for cross-institutional collaboration among AlipayHK, Standard Chartered Bank (Hong Kong and Singapore), and GCash. A distributed ledger supports distributed processing and also provides all participants with a uniform business ledger and view.

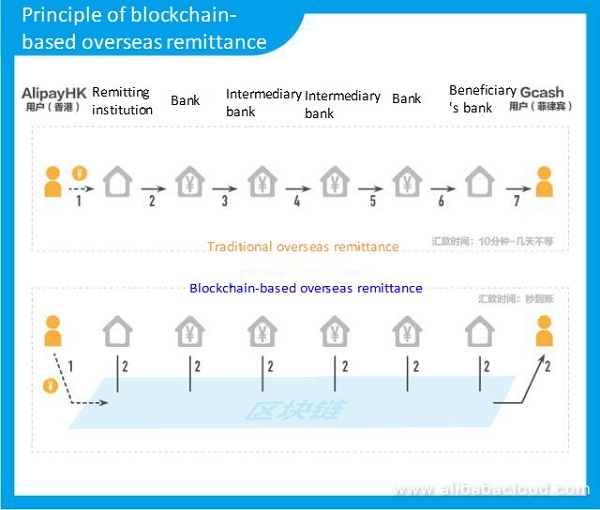

Figure 4: Diagram illustrating the principle of blockchain-based overseas remittance.

With the distributed ledger technology, the blockchain technology transforms the remittance mode from node-by-node confirmation and transmission like a relay race to real-time, synchronous, and parallel verification by service nodes, which improves the efficiency and changes the operation mode. When the wallet at the remittance end sends a remittance, all participants receive the information simultaneously and collaborate to complete the remittance transaction simultaneously on the blockchain after the audit required for compliance. If any problems occur during transfer (for example, violation of relevant provisions), such issues will get reported to the remitter in real time.

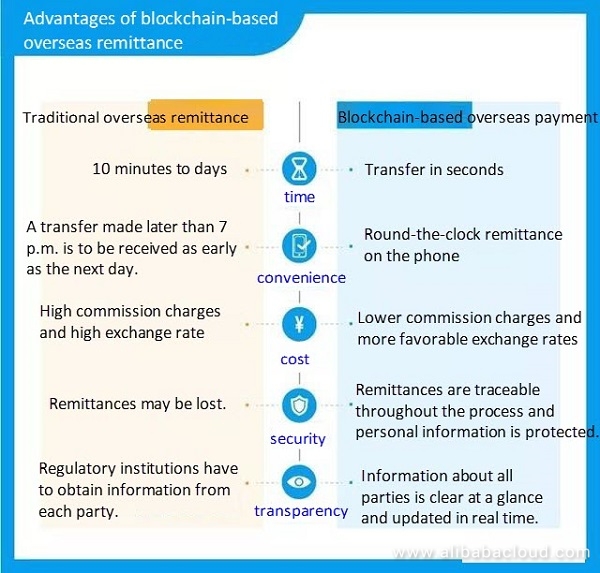

With the support of the blockchain technology, the cross-border remittance service of Ant Financial can provide quick, secure, convenient, low-cost, and transparent services.

Figure 5: A comparison of traditional and blockchain-based overseas remittance services.

Blockchain-based cross-border remittance introduces the following features:

It is unprecedented to allow every user to complete cross-border remittances using the blockchain technology. It is a road never taken before. We need to negotiate with all participants and work out solutions. For example, the blockchain-based cross-border remittances get completed with consortium blockchain. In this specific business scenario, how to design consortium blockchain, how all participants cooperate, and how to define authorities and duties are the challenges for Ant Financial to work on the blockchain technology.

The blockchain is the most popular technology in the Internet industry in the past year, but many people think of it as "issuing currencies," "getting rich overnight," and "reshuffle." According to Eric Jing, these bubbles will burst, and the real value of blockchain will be revealed. The blockchain serves to create a multi-party trust mechanism, address the credibility of data, goods, assets, contracts, and individuals, and promote active collaboration among agencies and individuals.

At the event, he proposed "three dos and three don'ts" concerning Ant Financial's blockchain. In other words, Ant Financial will solve practical problems with social value, continually overcome technical obstacles of large-scale practical application, and work with partners to build an open blockchain ecosystem. Ant Financial will not jump on the bitcoin bandwagon, go against laws or regulations, or damage data security and privacy of users.

The challenge for cross-border remittances lies in practical problems with social value. As multiple participants are involved, the traditional serial mode requires remittance information to be transmitted and confirmed step by step, which is time-consuming and labor-intensive. Instead, blockchain upgrades the remittance mode to the parallel mode based on a distributed shared ledger and smart contracts, which supports real-time sharing of transaction information, saves transmission time and reconciliation and settlement costs, and makes the real-time transfer, low costs and favorable exchange rates possible.

The blockchain technology can also lower risks and provide more transparent supervision and more efficient risk control for cross-border remittances. The regulatory institutions in Hong Kong and the Philippines can monitor individual cross-border remittance links in real time and throughout the process, significantly improving timeliness and effectiveness.

At the press conference, Eric Jing said that he was delighted to see the blockchain technology used to improve the lives of common people. The press conference is aptly named "Bringing distances nearer even when miles apart," which shows that the power of technological innovation can bring trust and happiness to everyone. According to Eric Jing, as a technical enterprise, Ant Financial believes that what changes the world is the mission, dream, and values behind technologies instead of mere technologies.

Eric Jing summed up the technical value of Ant Financial as a "sweet technology." With technologies, Ant Financial makes finance inclusive, transparent, simple, secure, and credible and warms every ordinary person and micro-sized as well as small enterprise based on financial goodwill.

Read similar blogs and learn more about Alibaba Cloud's products and solutions at www.alibabacloud.com/blog/.

2,593 posts | 792 followers

FollowAlibaba Cloud Blockchain Service Team - January 17, 2020

Alipay Technology - August 21, 2019

Alibaba BlockChain Service Team - August 27, 2018

Alibaba Cloud Blockchain Service Team - August 19, 2019

Alibaba Cloud Blockchain Service Team - January 17, 2020

Alibaba Clouder - October 15, 2018

Hi jatin143,If you mean the demo for the principle of block chain, please refer to this link: https://image-intl.alicdn.com/15299183275803aa35c219b.gif

2,593 posts | 792 followers

Follow EDAS

EDAS

A PaaS platform for a variety of application deployment options and microservices solutions to help you monitor, diagnose, operate and maintain your applications

Learn MoreMore Posts by Alibaba Clouder

Raja_KT March 18, 2019 at 4:12 pm

Interesting one. By now, how many are using proprietary Ant Financial Blockchain. Hyperledger fabric is open source blockchain framework also being used?