Each day, as the school bell rang, students poured out of the school gate, stepped into small canteens in groups, and chose what they like. At that time, some TV series, such as The Legend of White Snake, Journey to the West, and Princess of Pearl, were replayed constantly left deep impressions on audiences. Some TV series, such as Clever Boy, My Own Swordsman, and The Storm Riders, used extravagant costumes and caused a wave of imitation. Trendy dramas, such as Meteor Garden and The Story of Youth, emerged and attracted many students. Many students imitated the characters, especially leading actors, and they became extremely popular among other students.

In those years, most people did not care about copyright. Various merchants seized the opportunity and combined popular movies and TV series within the packages of their products. Candies, postcards, blind box cards, and many other products for students became luxury items. The popularity saw some students choose to save their breakfast money for a week to collect all the Storm Riders cards. Unfortunately, most of them failed to collect all cards.

As the years progressed, the animation, comic, game, and novel (ACGN) subculture became more popular. Animation series from countries outside China were incredibly popular, including Sailor Moon, Card Captor Sakura, and Transformers. Unsurprisingly, many small products, such as popsicles, erasers, and exercise books, based on these animation series were sold in small stalls throughout China.

Among the various popular animated characters, a cute blue cat from Japan came into the public's view in China.

Although Doraemon was known in China in the 1990s through cartoons, IP derivatives of Doraemon were not officially authorized in Mainland China until 2006. Therefore, most of the derivatives of Doraemon before 2006 were pirated. The brand image of Doraemon in China was extremely chaotic due to the amount of pirated derivatives and different Chinese names. CCTV called it Dora-Ameng. In Taiwan, Doraemon was called Xiaodingdang, but in Hong Kong, it was called Dingdang. Some even called Doraemon Jiqimao, which literally translates to the robot cat.

In 1996, two years after the death of Fujiko F. Fujio (one of the authors of Doraemon), Doraemon agents worldwide reached a consensus and unified the name as "Doraemon" after discussions related to the author’s wishes.

As one of the most popular first-line IPs in the world, hundreds of brands have collaborated with Doraemon, covering thousands of products in food, clothing, housing, and transportation.

Zhu Xiaoju is the General Manager of Animation International, the authorized copyright holder of Doraemon in China. According to her, the sales of authorized Doraemon derivatives in China are currently about 1-2 billion yuan.

The popularity of Doraemon is not a special case. In recent years, the demand for personalized and scenario-based consumption is increasing. More brands have begun to develop new products by collaborating with well-known IPs.

The most common IPs in the market are listed below:

Character IPs are the most common among the three types. The animation series may not be viewed in China by as many people as in years previous, but the highly recognizable characters are still discussed and shared among a wide range of people. For this reason, IPs of this type are the priority for many brands.

Lu Xiaowen is a researcher at the Institute of Sociology at the Shanghai Academy of Social Sciences. In an interview with China News, he says young people nowadays are keen on collecting their favorite daily necessities, which is a new consumption phenomenon. "For example, young people may be willing to buy limited products printed with photos of idols or products related to IPs. This is a new consumption phenomenon and can also become a new means of promotion."

In Lu's view, the feature of this new consumption behavior is how young people store the memories of their youth through collectibles. "This may be caused by the worship of idols or the preference for certain items (related to IPs)."

For the brands, it is only the first step into the consumption trend. They must focus on finding the right IPs to succeed.

Zhu Xiaoju says, “For IPs, the collaboration with brands is alongside with standards and considerations.”

It is the same for brands.

Watanabe is the General Director of Digital Marketing at Casio of China. Watanabe thinks IPs and brands are in a complementary relationship during cooperation. "If the IP is contrary to the idea of the brand, the brand will be affected."

In the past, many brands, including Casio, chose IPs based on the IP popularity and their own experience. "They lack the insight into the fit of IP and the brand and cannot estimate the outcome data, such as purchase conversion."

During the 2020 Double 11 Global Shopping Festival, Casio gained insight into market preferences using the Alibaba Cloud Data Mid-End platform. It plans a series of marketing activities in advance. Casio achieves data insights in the whole procedure of "product-marketing-transaction" by focusing on products, content, and marketing methods.

Watanabe describes how Casio learned a considerable part of its online consumers have a strong perception and preference for fashion trends and animation using Quick Audience (one of the core services of the Alibaba Cloud Data Mid-End platform).

Casio learned that the oldest audiences of Doraemon are ages 20-29. This means that the audiences of Doraemon are not just kids. Doraemon animation was officially introduced in China in the early 90s and was watched by many people born throughout the 1980s and 1990s. Decades later, that generation has become some of the main consumers.

Casio x Doraemon Baby-G watch collaboration (pictured above)

Coincidently, the core consumers of Casio are also young adults.

Casio used the Alibaba Cloud Data Mid-End platform to realize the targeted and precise marketing of its new collaboration G-Shock with Doraemon. The marketing results surprised Casio.

The data shows the first batch of new products in the official Casio flagship store selling out during the 2020 Double 11 Global Shopping Festival.

In addition to the Doraemon collaboration, Casio also offered another six collaboration products on Tmall during Double 11, including a "limited edition gift box with Bai Jingting" and other watches from the "G-SHOCK" series.

Casio also focused on livestreaming to promote these new products better. The average audience number during Casio’s livestreams floated around 150,000, which is much higher than the average number of about 1,000 in the industry. This result depends on the Alibaba Cloud Data Mid-End platform.

On October 23, the Casio x Doraemon collaboration became an exclusive product in the live chat room of Weiya. On that day, product sales exceeded ten million RMB.

In addition to the live marketing of product collaboration with IPs, Casio wants to build the largest consumption market in the world using the Alibaba Cloud Data Mid-End platform.

Post-1970s consumers pay more attention to the cost-effectiveness. Post-1980s consumers focus on the quality of products. Post-1990s and Generation-Z (people born between 1995 and 2009) focus more on personalization and interest. Casio started providing products for Chinese consumers in the late 1970s and has gained a clearer understanding of Chinese consumers over time.

XCXD is the service provider that provides the entire service lifecycle for Casio in the Chinese market. XCXD also helps Casio explore the Chinese market deeply.

Hua Shan is the Deputy Director of Digital Marketing of the Casio Business Planning Department. He says that the biggest change in Casio's markets in recent years lies in the younger consumers. "All industries are competing for Generation-Z consumers. In consideration of this, it is even more necessary for Casio to gain insight into the needs of consumers in advance." Hua Shan also stresses that although Casio is an electronics provider, it also sells watches and clothes. "We need to use the Alibaba Cloud Data Mid-End platform to build a complete procedure that covers consumer asset construction, marketing strategy planning, marketing activity operation, and data accumulation. By doing so, Casio can improve the overall brand value further." Hua Shan says the digital construction of Casio is still in its initial stage. "Although Casio has accumulated a lot of data, it has not really used the data. The top priority now is to integrate and analyze the data to promote effective growth to the business and realize the full-channel data layout of Casio.”

The Alibaba Cloud Data Mid-End platform can assist Casio with its digital transformation.

Over the past few years, Casio has accumulated millions of consumer assets in Tmall flagship stores, brand stores, WeChat mini programs, and other new retail channels.

With Dataphin, one of the core services of Alibaba Cloud Data-Mid End platform, Casio has built the online consumer assets for the brand. It has also achieved the digital and online transformation of all business scenarios and integrated cross-system metrics, including transaction and after-sales.

For the critical inventory turnover in distribution projects, Dataphin can focus on goods management and fully-combine data, such as bar codes, characteristic attributes, and goods warehouses, with basic data. By doing so, Casio can build the data system of product assets and unify the standards. During big promotions like Double 11, Dataphin can help Casio estimate product sales based on the AIPL model, improve the efficiency of inventory turnover, and lower inventory pressure.

In terms of market insight and marketing management, Quick Audience can fully integrate marketing information from multiple platforms, such as TikTok, Bilibili, and NetEase Cloud Music. Casio does not need to make marketing strategies based on previous experience. Instead, it can learn to understand consumers based on real-world scenarios and personalized consumer needs. With the Alibaba Cloud Data Mid-End platform, Casio can achieve its goals in scenarios, such as new product collaborations and live marketing. In addition, Casio can seize new business opportunities, reduce costs, and improve efficiency.

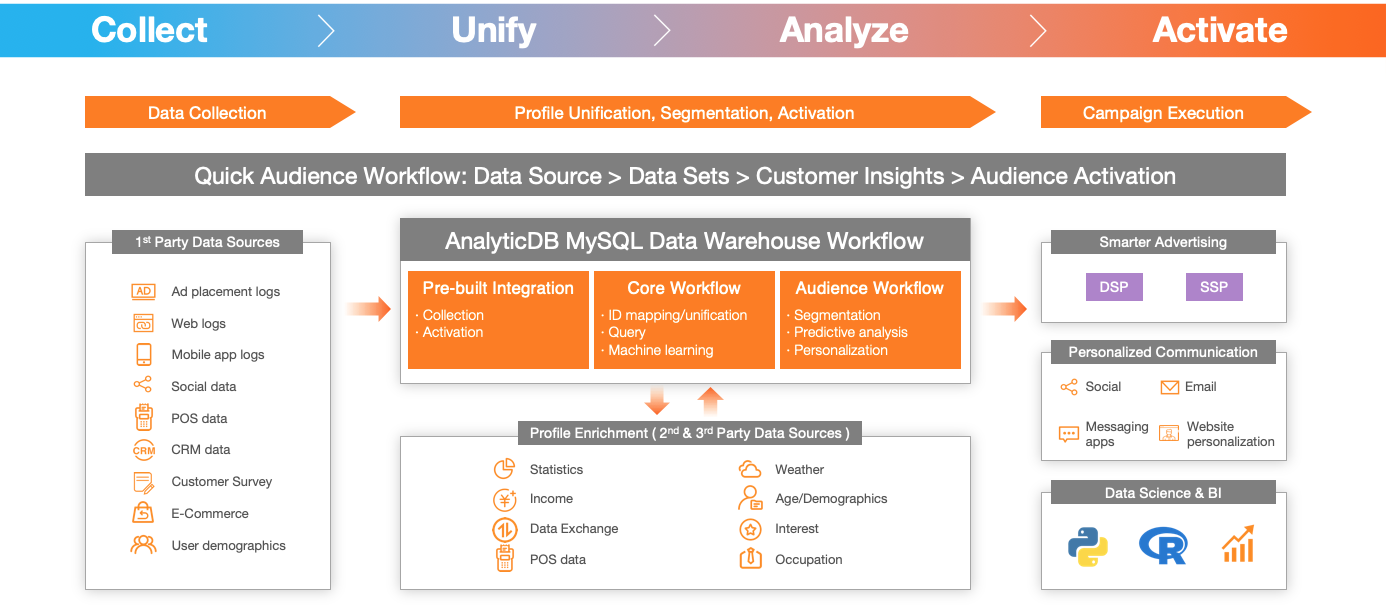

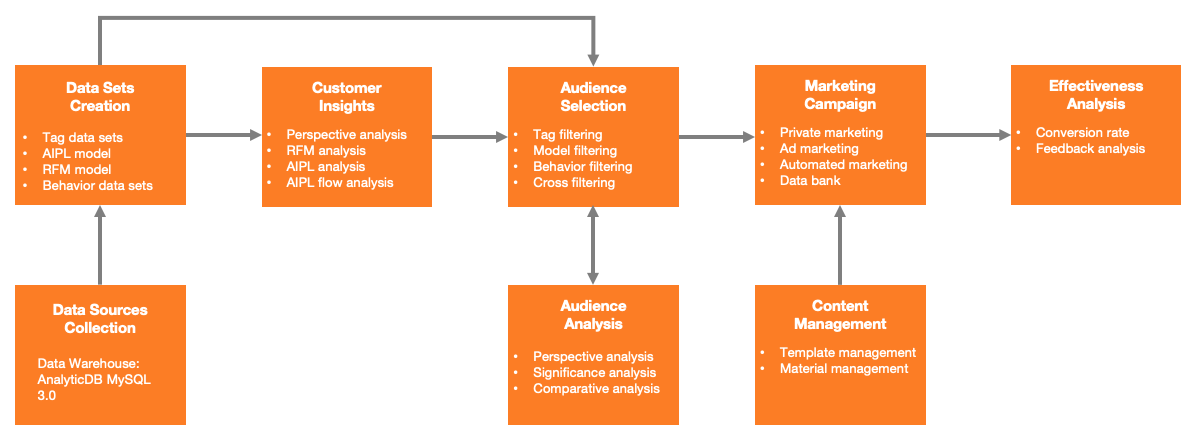

The chart below illustrates the workflow and application of Quick Audience and AnalyticDB MySQL in Casio marketing activities.

Starting from ingesting data into data warehouse AnalyticDB MySQL, Quick Audience manages the marketing life cycles, including data sources collection, data sets creation, customer insights, audience selection, audience analysis, marketing campaign, and effectiveness analysis.

In May 2020, Casio worked with Tmall Super Brand Day. Casio used the Alibaba Cloud Data Mid-End Platform to identify the target consumer group and achieve accurate promotion through live broadcasts online. More than 1.7 million consumers were attracted by online promotions, and more than 3.17 million consumers viewed products in online stores.

Watanabe says the online payment in China is currently leading the world. With the further development of social media and 5G technology, the Chinese market will soon become the largest market for Casio in the world. However, the growth depends on the support of the Alibaba Cloud Data Mid-End platform. Watanabe believes that in the future, the consumption channels and preferences of consumers will continue to change. "Casio must continue to meet the needs of consumers and adjust and implement the layout of strategies for goods and marketing."

"Data is the prerequisite for sustainable brand development." Watanabe says, "The Alibaba Cloud Data Mid-End platform can help brands integrate and standardize multi-system data and apply it to various businesses. This is also the basis for the cooperation of enterprise personnel and efficient business development."

The Alibaba Cloud Data Mid-End platform is the only way for enterprises to achieve digitalization and intelligence transformation. The Alibaba Cloud Data Mid-End platform is a fast, accurate, comprehensive, unified, and integrated system for intelligent big data that integrates methodologies, tools, and organizations.

Using Dataphin as the core, the product matrix of the Alibaba Cloud Data Mid-End platform applies a series of "Quick" products, which are applicable to specific business scenarios. The Data Mid-End platform services include:

For more information, please visit the official website of the Alibaba Cloud Data Mid-End solution page at https://www.alibabacloud.com/solutions/omnichannel-data-mid-end

ApsaraDB for Redis 6.2: Enhanced Geographic Location Features

Iain Ferguson - May 25, 2022

Alibaba Cloud MaxCompute - March 3, 2020

Alibaba Clouder - May 23, 2018

ApsaraDB - November 17, 2020

Alibaba Clouder - March 10, 2021

Alibaba Cloud MaxCompute - December 8, 2020

Big Data Consulting Services for Retail Solution

Big Data Consulting Services for Retail Solution

Alibaba Cloud experts provide retailers with a lightweight and customized big data consulting service to help you assess your big data maturity and plan your big data journey.

Learn More Big Data Consulting for Data Technology Solution

Big Data Consulting for Data Technology Solution

Alibaba Cloud provides big data consulting services to help enterprises leverage advanced data technology.

Learn More Quick BI

Quick BI

A new generation of business Intelligence services on the cloud

Learn More Cloud Migration Solution

Cloud Migration Solution

Secure and easy solutions for moving you workloads to the cloud

Learn MoreMore Posts by ApsaraDB