Centralized cryptocurrency exchanges have become essential to the digital asset ecosystem, linking traditional finance with the decentralized future. These platforms enable millions to trade, invest, and manage crypto assets efficiently, serving as gateways to the crypto economy. As the market matures, exchanges are rapidly evolving to meet the diverse needs of retail and institutional investors. Leading exchanges increasingly depend on Alibaba Cloud for its scalability, high performance, and robust security to stay competitive in the nonstop crypto market.

The relentless pace and complexity of crypto markets have also fueled the rise of algorithmic trading, reshaping how participants interact with digital assets. Operating 24/7 with high volatility and vast real-time data, crypto markets create an ideal environment for automated trading strategies that process and act on information faster than any human.

Building effective algorithmic trading systems for crypto exchanges, however, requires more than speed—it demands mastery of cloud technology. Since exchanges rely on cloud infrastructure, connecting to them efficiently calls for expertise in cloud networking and advanced latency optimization. This article, the first in a series, introduces low-latency crypto trading on the cloud, offering foundational insights to leverage Alibaba Cloud for a competitive edge.

At the core of every traditional and centralized crypto exchange, lies the matching engine, a sophisticated system responsible for processing and matching buy and sell orders. When a user places an order, the matching engine identifies a corresponding counterorder and executes the trade based on predefined parameters like price, volume, and time priority. This engine continuously updates order books, ensures market integrity, and usually supports various order types such as market, limit, and stop-loss orders. The performance of the matching engine is critical; it directly influences trade execution times, liquidity, and user satisfaction, making speed and reliability top priorities.

Crypto exchanges differ fundamentally from traditional financial exchanges like the NYSE or NASDAQ in their infrastructure and operational design. Traditional exchanges rely on proprietary data centers to handle high-frequency trading within tightly regulated environments. Traders' speed typically depends on geographic proximity to the exchange’s infrastructure, and transactions are processed within fixed trading hours, supported by clearinghouses that validate trades.

In contrast, crypto exchanges leverage cloud infrastructure to achieve global reach, low latency, and 24/7 availability. Cloud providers like Alibaba Cloud enable these exchanges to deploy services in data centers that are run by the provider instead of maintaining these themselves. Crucially, cloud platforms utilize virtualized networking, where routing decisions are influenced by overlay networks rather than the physical network underneath. This makes latency optimization much more complex, as proximity alone doesn’t guarantee faster transactions! Understanding virtual routing within cloud environments therefore becomes crucial for achieving optimal performance.

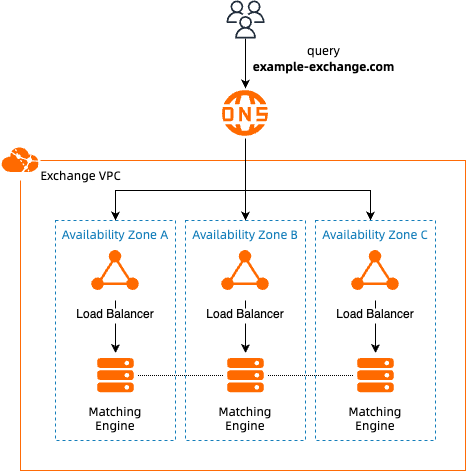

A simplified cloud architecture of a crypto exchange might look something like this:

At its core, a typical cloud-based crypto exchange architecture includes a matching engine deployed in key regions—often major hubs like Tokyo, Singapore, or Hong Kong—and managed by load balancers to handle incoming traffic. These components are distributed across availability zones, which are clusters of closely located data centers, ensuring both resilience and scalability. However, even within the same availability zone, physical distance between servers and load balancers can impact latency—a millisecond difference that can be crucial in low-latency trading scenarios.

For instance, a load balancer might have cross-zone load balancing enabled. This means that even if you attempt to connect to the endpoint with the lowest latency, your request could ultimately be routed to a different data center entirely! We will delve deeper into this concept in a future article. For now, let’s explore the basic options available to traders.

To address the varied needs of traders, Alibaba Cloud offers a suite of ultra-low latency solutions designed to meet these requirements. Alibaba Cloud's solutions utilize state-of-the-art 8th Generation ECS bare metals and virtual machines, powered by Intel® Xeon® Sapphire Rapids and Emerald Rapids processors. Each machine can process up to 30 million packets per second (PPS) and provides 25 Gbps bandwidth, ensuring the high performance and throughput necessary for competitive trading environments. Broadly, these solutions can be categorized into two types: colocation and public internet trading. In addition, Alibaba Cloud can also connect your existing on-premises environments to the cloud.

Colocation involves deploying trading software within the same data center as the exchange's matching engine and establishing a private connection between the two Virtual Private Clouds (VPCs) where these systems are located. With microsecond-level latencies on Alibaba Cloud, colocation ensures nearly instantaneous trade execution. Exchanges might whitelist high-volume traders, granting them direct access to the exchange’s physical servers.

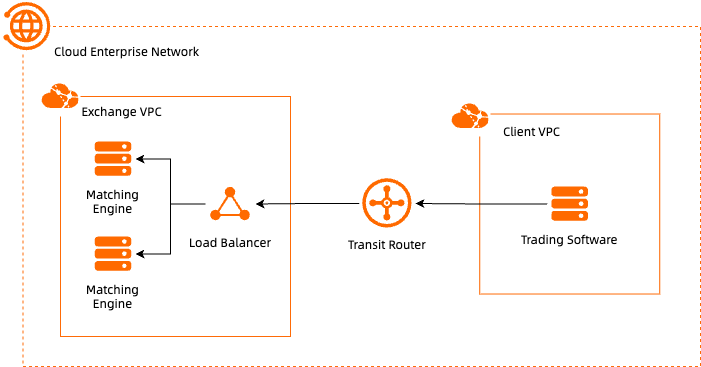

A simplified example of a crypto exchange colocation solution will look like this:

Client instances are located in the same facility as the exchange's matching engine, and network traffic is directly routed to the exchange servers. On Alibaba Cloud, you can set up such a peering connection between cloud environments through Cloud Enterprise Network (CEN), a fully managed networking solution that offers a seamless private backbone for securely and efficiently transferring data between VPCs. It also supports multicast functionality, similar to traditional financial environments.

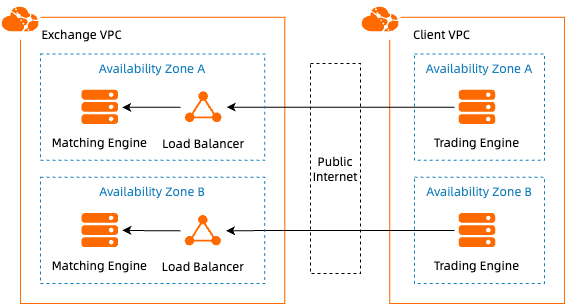

In addition to colocation, Alibaba Cloud excels in optimizing latency for trading strategies that rely on the public internet. Instances can still be deployed in the same data center as the exchange, but the connection between them occurs via the public internet. This typically results in latencies of 1 millisecond or more within the same availability zone. By carefully designing your cloud architecture to ensure that your trading applications connect to closest endpoints, you can build a reliable and robust trading solution. This approach is well-suited for strategies that can tolerate tail latency and do not require microsecond-level response times.

Below is an example of a public internet trading solution. Client instances may be located in the same instance as the matching engine, but traffic will be routed over the public internet:

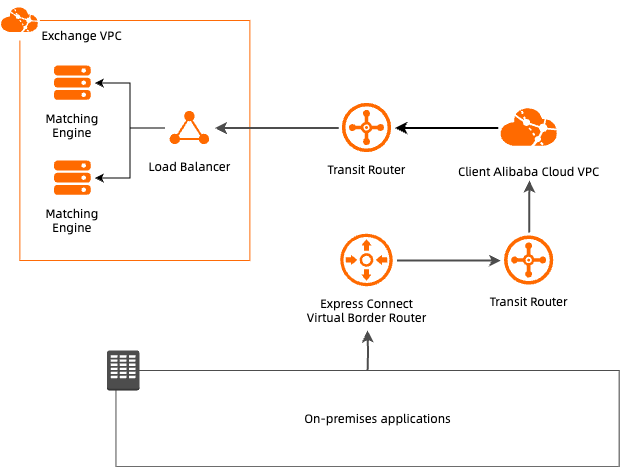

Some traders might operate their own on-premises data centers where their algorithmic trading modules reside. Alibaba Cloud empowers these clients to achieve ultra-low-latency connections to its cloud infrastructure through Express Connect. This dedicated network service establishes a direct, private link between an on-premises data center and Alibaba Cloud’s ecosystem, bypassing the public internet to ensure faster and more secure data transmission.

By utilizing Alibaba Cloud’s Cloud Enterprise Network and strategically located points of presence (PoPs), traders can optimize routing and minimize network hops. Furthermore, Express Connect supports high-bandwidth options—each connection offering speeds of up to 100 Gbps—along with advanced traffic prioritization to ensure critical trading data reaches Alibaba Cloud-hosted matching engines or trading systems with minimal delay.

This robust setup enables clients to seamlessly integrate their existing infrastructure with Alibaba Cloud, delivering the performance and reliability essential for latency-sensitive operations:

As demonstrated, Alibaba Cloud plays a key role in empowering traders to achieve the low-latency performance critical for competing in the cryptocurrency market. With solutions designed for both colocation and public internet trading, it offers a flexible and reliable platform for traders to seamlessly connect to exchanges hosted on its infrastructure.

This article serves as the first in a series, providing a foundational introduction to low-latency trading on the cloud. There are many more challenges to address, including websocket connections, efficient multicast implementation, cross-region routing, and ECS optimization.

Stay tuned for the next installment, where we’ll explore cross-availability zone latency monitoring and delve into strategies for measuring and optimizing websocket feed latency effectively.

For any questions or to discuss customized solutions, don’t hesitate to reach out to me!

2 posts | 1 followers

FollowAlibaba Cloud Community - December 13, 2024

Kevin Scolaro, MBA - May 16, 2024

Marketplace - April 13, 2021

Alibaba Cloud Native - June 7, 2024

Marketplace - February 21, 2019

PM - C2C_Yuan - September 1, 2023

2 posts | 1 followers

Follow Forex Solution

Forex Solution

Alibaba Cloud provides the necessary compliance, security, resilience and scalability capabilities needed for Forex companies to operate effectively on a global scale.

Learn MoreMore Posts by Daniel Molenaars