Real-time, Accurate, Easy-to-use,

and Intelligent Risk Control Platform

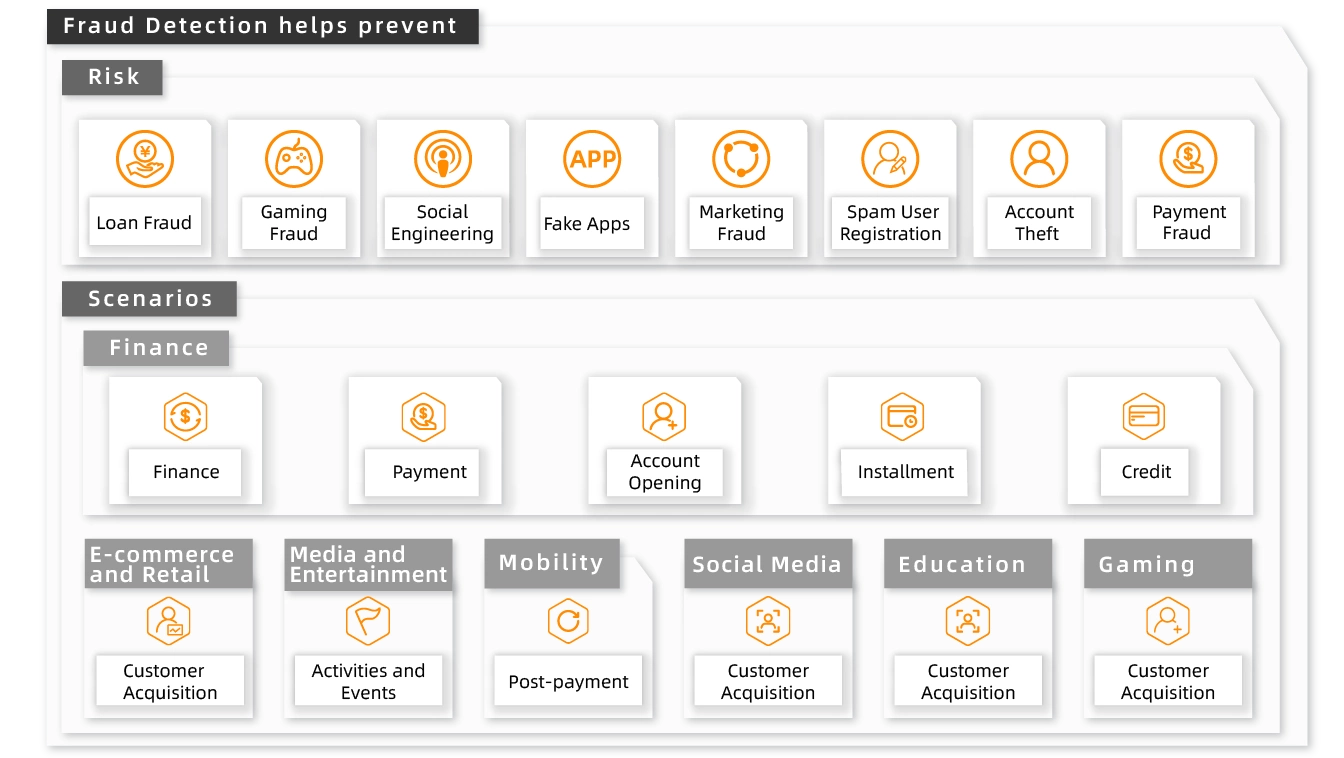

Fraud Detection is a risk control platform, which is based on machine learning algorithms and stream computing technologies. You can use Fraud Detection to identify frauds in core services, such as user registrations, operations, transactions, and credit audits. Fraud Detection provides an end-to-end, anti-fraud system tool that is suitable for industry scenarios such as e-commerce, social networking, and finance.

Fraud Detection helps reduce risks during business growth by using the best practices in risk control that Alibaba Cloud has developed for over 10 years. The protection capabilities provided by Fraud Detection are tested by world-class promotional events.

Real-time Risk Identification

Delivers high-dimensional computing in milliseconds, ultra-high concurrency, high performance, and high scalability based on the computing power and network infrastructure provided by Alibaba Cloud. You can connect your services to Fraud Detection from multiple regions worldwide to enable real-time risk detection.

Zero-code Platform Providing Intelligent Algorithm-based Policies

Provides an easy-to-use graphical user interface and an automated policy recommendation system by using supervised models and unsupervised intelligent algorithms. The models and algorithms are developed based on a large number of samples.

End-to end Protection

Identifies various risks based on cutting-edge techniques such as edge computing and intelligent attack and defense, and supports device-to-cloud analysis and dynamic protection.

Challenges

Rising Challenges of Frauds

An increasing number of enterprises are engaged in online business. Meanwhile, online frauds become rampant. Fraudsters exploit advanced technologies and find new ways to target enterprises. Fraudsters each focus on a specific vulnerability. Every year, more than 10% of the marketing funds of enterprises go to fraudsters. In the financial sector, loss caused by frauds reaches tens of billions of dollars every year.

Unscalable Internal Risk Control Systems Failing to Support Business Development

Rapid business growth and diversification are often accompanied by challenges. In most cases, the internal risk control systems of enterprises are difficult to scale, and risk control methods are unable to resolve issues brought by business development. As a result, the development of risk control systems lags behind business development.

Real-time Risk Control

Registrations, logons, payments, and even complex credit applications need to be completed in seconds. Timeliness has become one of the most important factors that affect user experience.

Scenarios

Features

Atomic Capabilities of Risk Control

Identifies security risks in devices, mobile phones, and IP addresses. You can apply the capabilities to your risk control systems.

Device Risk Identification

Identifies mainstream security risks in devices by using different SDKs. The SDK for JavaScript is specific for PCs.

Decision-making Engine Platform

A visualized, easy-to-use, and AI-based risk operations platform. This platform helps build an end-to-end operations system for risk control.

Risk Management in All Scenarios

Provides various event templates to quickly customize business scenarios.

Multi-level Risk Control

Provides multi-level risk control for both devices and services.

Various Feature Variables

Supports custom variables, cumulative variables, and lists to analyze risk features from multiple dimensions.

Intelligent Risk Laboratory

Helps enterprises build intelligent operations systems for risk control by using features, such as intelligent recommendations based on AI algorithms, event playbacks, and simulation.

Stream Computing and High Scalability

Provides results about risks in real time based on cloud computing. The computing capabilities can be scaled based on the business volumes.

How to Deploy Fraud Detection Decision Engine

1

Create Events

Creates risk control events based on your business scenarios, such as registrations, logons, marketing, and payments.

2

Associate Variables

Defines the variables that are required for risk control events. Simple variables, complex variables, lists, and cumulative variables are supported.

3

Edit Policies

Configures variables and conditions. An event can contain multiple policies, and a policy can contain multiple conditions.

4

Call API

Calls the API of the decision-making engine to obtain the risk identification results in real time when a risk control event, such as account registration, occurs.

Fraud Detection Pricing

|

Item |

Features |

Pricing (USD/Year) |

|---|---|---|

|

Decision Engine Basic |

QPS: 500 Event: 50 Policy: 100(5 sets) List: 10 lists, each has less than 10,000 rows Policy replay: 1 task, each has less than 10,000 rows of data API Variable: 20 |

74,292.00 |

|

Decision Engine Advanced* |

QPS: 2,000 Event: 500 Policy: 500 List: 100 lists, each has less than 10,000 rows Policy replay: 10 tasks, each has less than 100,000 rows of data API Variable: 100 |

148,584.00 |

|

Device Security Package (Numer of API Calls) |

1,000,000 |

1,238.00 |

| 10,000,000 |

9,906.00 |

|

| 30,000,000 |

23,774.00 |

|

| 50,000,000 |

31,698.00 |

|

| * Free not more than 3 sets of common policies for cold start (1 set about 20 policies). | ||

Documentation and Tools

Common Parameters

The common request parameters and common response parameters of the Fraud Detection API operations

Policy Lab

Policy Lab provides the policy restore, policy replay, variable recommendation, and variable and model customization features.

Device Fingerprint SDK for Android

How to integrate and use Device Fingerprint SDK for Android

Device Fingerprint SDK for iOS

How to integrate and use Device Fingerprint SDK for iOS